Shareholder Returns Policy

Shareholder Returns Policy

The Company positions shareholder returns as an important managerial issue and aims to maintain a total return ratio of 40% or higher with dividends as its base, comprehensively considering factors such as its business performance, investment plans, and business environment each fiscal year. The Company will pay dividends at the DOE rate (rate of dividends to equity attributable to owners of parent) of 3.5%. If its dividend amount is below a total return ratio of 40%, the Company will address the situation mainly through share repurchases. Equity attributable to owners of parent, which forms the basis of DOE, excludes “Other components of equity” that fluctuate significantly due to the impact of foreign exchanges and other factors, because the Company aims to deliver progressive dividend payments.

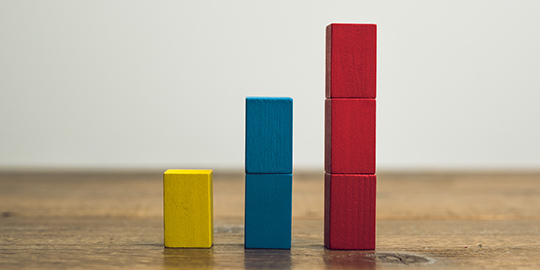

Trends in Shareholder Returns

* At the Board of Directors Meeting held on August 7, 2025, the Company resolved to repurchase treasury stock of up to 50 billion yen.

Dividend

The interim dividend for the fiscal year ending March 2026 was 57 yen per share. The year-end dividend is forecast to be 58 yen per share, resulting in an annual dividend of 115 yen.

* Forward-looking statements are based on the information available at the time of announcement (November 10, 2025) and are subject to various risks and uncertainties that could cause actual results to vary materially.

Stock Prices

| FYE 2021 | FYE 2022 | FYE 2023 | FYE 2024 | FYE 2025 | |

|---|---|---|---|---|---|

| Highest (yen) | 2,684 | 2,413 | 2,653 | 3,512 | 3,614 |

| Lowest (yen) | 1,672 | 1,665 | 1,798 | 2,023 | 2,167 |

* Share prices are Tokyo Stock Exchange (Prime Market) market quotations.