Risk Management

Our Approach

The SUBARU Group is undertaking risk management as one of its key priority management issues, not only to address emergency situations when they arise but also to deal with various risks that have a serious impact on daily corporate activities, as well as to minimize damage when risks emerge.

The automotive industry is ushering in a major transformation, which only occurs once in a hundred years. The SUBARU Group, which operates businesses globally, is aiming to enhance the resilience of its management infrastructure by ensuring the sustainability of its businesses by quickly tackling changes in world affairs. At the same time, the Group must boost its measures to minimize its human, social and economic losses. Amid this environment, it is essential to strategically conduct risk management throughout the Group to conduct business activities. We therefore believe it is important to create a SUBARU Group that has an infrastructure that is resilient to risk to enhance our corporate value.

Management System

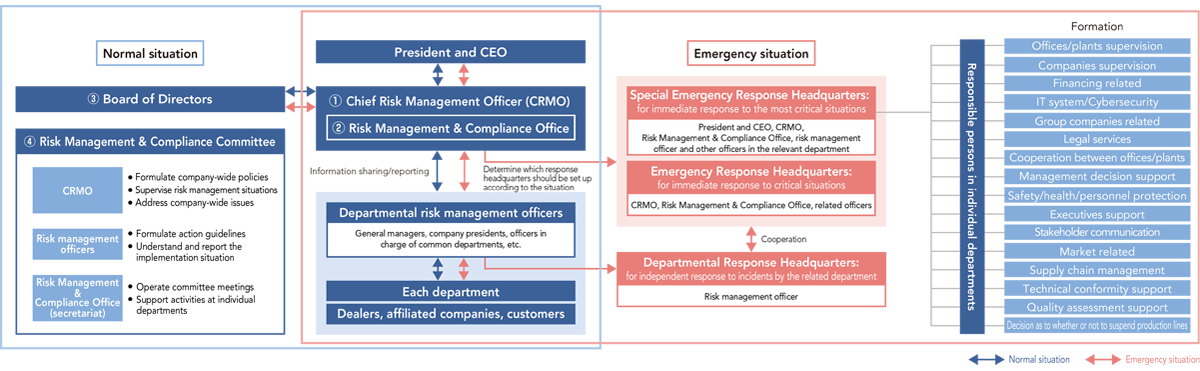

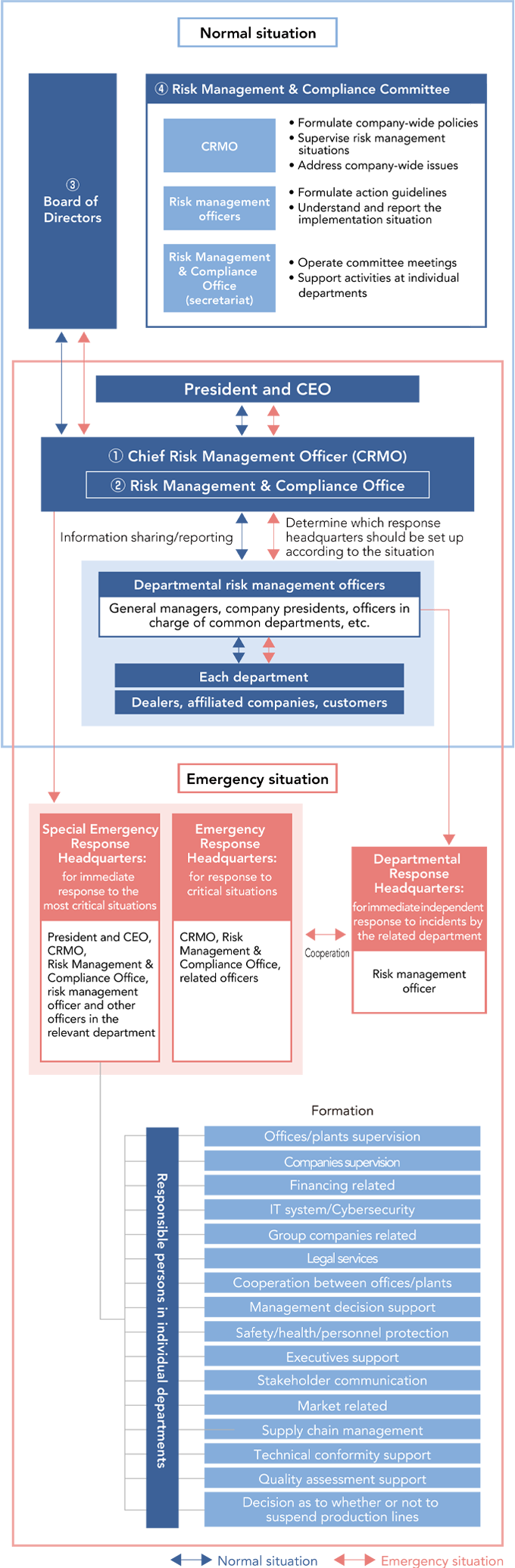

To prevent the emergence and expansion of risks to the SUBARU Group, the Chief Risk Management Officer (CRMO) appointed by the Board of Directors leads risk management and compliance activities, reporting their status to the Board of Directors.

As a system to promote risk management, SUBARU has appointed risk management officers (job grade of Chief General Managers) for each department and established the Risk Management and Compliance Committee. This committee is chaired by the CRMO, and its vice-chairperson is the vice president in charge of the duties of the Risk Management Group, comprised of the Risk Management and Compliance Office and the Legal Department. At this committee, members deliberate, discuss, make decisions, and exchange/communicate information on important matters. The results of these activities are deliberated and reported on at the Board of Directors.

The CRMO leads corporate Group-wide efforts to enhance risk management with professional support from experts in corporate departments, such as the Risk Management and Compliance Office and the Legal Department. In this leadership role, the CRMO works closely with the Corporate Planning Department, which performs division-encompassing functions, as well as different divisions and companies. The Audit Department audits execution of tasks by each division and subsidiary in a planned manner.

Risk Management System

Risks Associated with Business Activities

The SUBARU Group is undertaking risk management as one of its key priority management issues, not only to address emergency situations when they arise but also to deal with various risks that have a serious impact on daily corporate activities, as well as to minimize damage when risks emerge.

The major business risks are listed below.

Please note that this is not an exhaustive list of all risks relating to the SUBARU Group.

Risks related to changes in the economic and financial environments

(1) Economic trends in major markets

(2) Exchange rate fluctuations

(3) Financial markets fluctuations

(4) Change in raw material costs

Risks related to industries and business activities

(5) Focus on specific businesses and markets

(6) Changes in the demand and competitive environment in the market

(7) Responsibility related to products, sales and services

(8) Supply chain disruptions

(9) Intellectual property infringement

(10) Cybersecurity

(11) Compliance

(12) Legal proceedings, e.g., lawsuits

(13) Stakeholder communication

(14) Respect for human rights

(15) Secure and train human resources

(16) Climate change

Risk of regulations and events in various countries that impact other business activities

(17) Political, regulatory and legal procedures in various countries that impact business activities

(18) Geopolitical and geoeconomic disasters (international conflicts, terrorism risk)

(19) Damage related to natural disasters

(20) Outbreak of infectious diseases, etc.

Initiatives

In FYE March 2024, the Risk Management and Compliance Committee, as part of its initiatives during times of normalcy, continued to promote activities for controlling risks during daily operations. It did this by prioritizing high-impact issues under our Group-wide Risk Management Policy and Risk Management Code of Conduct formulated for each department.

As specific initiatives, we updated the priority issues to be addressed based on the New Management Structure Policies announced in August 2023, and we formulated a new Risk Map through discussions at the management level. In addition, to manage risk in a way that is optimized for the entire Group, we held risk management workshops mainly for risk management officers and employees in charge of risk management, working to improve risk literacy for Risk Management and Compliance Committee members and invigorate committee activities. Other efforts to reduce the SUBARU Group's key risks, such as strengthening cybersecurity, promoting supply chain BCP, and managing recovery responses during natural disasters, are ongoing, and the Risk Management and Compliance Committee regularly followed up on these efforts to improve their effectiveness.