Prominence 2020

New Mid-Term Management Vision: “Prominence 2020”

May 9, 2014

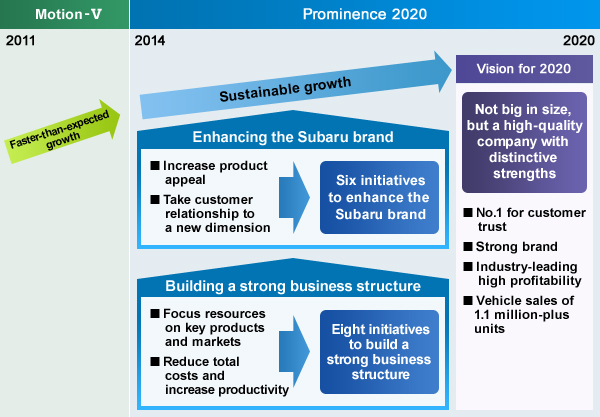

Tokyo, May 9, 2014 - Fuji Heavy Industries Ltd. (FHI), the manufacturer of Subaru automobiles, today announced its new mid-term management vision, “Prominence 2020”, developed to strengthen its competitiveness and business structure for a new stage in the aim of sustainable growth of the company.

In the new management vision “Prominence 2020”, FHI, as a small-sized automaker, has set its corporate vision for 2020 as “not big in size, but a high-quality company with distinctive strengths”. To achieve this goal, the company will focus on two activities - “enhancing the Subaru brand” and “building a strong business structure” - through which it will further pursue added-value business and increase tolerance for changes in the business environment.

FHI has been managing its operations on the basis of the “Motion-V” mid-term management plan announced in July 2011 for the period through FYE2016. By the end of FYE2014, the company has accomplished ahead of schedule the main targets of the “Motion-V” with successes in unit sales increase through US-oriented product development, commitment to safety including its highly-rated collision safety and “EyeSight” driving assist system, cost reduction efforts, low-incentive sales, and continuous efforts on highly efficient production.

However, in light of the fact that the strong financial performance was partly boosted by favorable conditions such as correction of the yen appreciation, FHI recognizes the need to further fortify its business base. With significant changes in its management environment resulted from the faster-than-expected growth as well as changes in the external business environment such as stricter environmental regulations, the company faces many tasks to be addressed including compliance with future environmental regulations, production capacity shortages, response to new customers, high sensitivity to currency fluctuations, and challenges to growth of the company's non-automotive businesses. FHI aims for further growth with resetting of its management goals and accelerated response to such business environment changes.

FHI remains true to its management philosophy - to become “a compelling company with a strong market presence” on the basis of “customer-first” policy. Pursuant to its vision of “not big in size, but a high-quality company with distinctive strengths” set forth in the “Prominence 2020” management vision, FHI will continue to pursue engineering excellence and offer its customers “Enjoyment and Peace of Mind” to achieve FHI/Subaru distinctive presence underpinned by its strengths such as “being No.1 for customer trust”, “brand strength”, and “industry-leading high profitability”.

- New Mid-Term Management Vision “Prominence 2020”PDF/2.4MB (announced on May 9, 2014)

- Revised Three-Year Investment PlanPDF/38kB (announced on May 8, 2015)

New Mid-Term Management Vision “Prominence 2020” : Key Activities

Focus on two activities - “Enhancing Subaru Brand” and “Building Strong Business Structure”

Six Initiatives to Enhance the Subaru Brand

-

Overall performance

Further pursue “Enjoyment and Peace of Mind” with commitment to basic performance and performance feel.

-

Safety

Become a No.1 brand for overall safety with “All-Around Safety” protecting all passengers and pedestrians.

-

Design

Express new Subaru distinctive design created on “Dynamic & Solid” concept.

-

Environmental efforts

Aim for top-level environmental performance in both areas of internal combustion engines and vehicle electrification.

-

Quality & Service

Become a trusted brand that satisfies customers in quality and service.

-

Communication

Build stronger ties with customers through the kind of communication that only a small, distinctive brand can have.

Eight Initiatives to Build a Strong Business Structure

-

Product strategy

Enhance product lineup with focus on SUVs and continuously launch new products.

-

Market strategy

Target global sales of 1.1 million-plus vehicles with North America as the top-priority market and Japan and China as the second-pillar markets.

-

Production strategy

Increase overseas production. Raise global capacity up to 1.07 million units according to necessity.

-

Total cost reduction

Set out company-wide efforts to achieve 20% increase in total productivity by 2020.

-

Alliance

Generate further synergies.

-

Aerospace

Step into a new stage - from autonomy to growth.

-

Industrial products

Achieve growth in both vehicle and general-purpose engines.

-

Human resource development, Organization & Corporate culture

Enhance human resource development and corporate culture to become a compelling company with a strong market presence.

Profit Projection for 2020

- Steadily achieve high level of operating margin within the industry

- Grow sustainably to achieve sales volume of 1.1 million-plus vehicles and net sales of 3 trillion-plus yen

Three-Year Business Operation / Profit Plan

- Establish a foundation for the future by expanding R&D spending and capital expenditures during FYE2015–17 period.

- Maintain profit levels by having added-value enhancement and total cost reduction absorb rises in fixed costs due to increased investments.

| Business Operation / Profit Plan for FYE2015–17 (3 years) | |

|---|---|

| Net Sales | 8 trillion yen |

| Operating Income | 1 trillion yen |

| Operating Income Ratio | 12.5% |

Currency rate assumption: 95 yen/US$

Revised Three-Year Investment Plan (announced on May 8, 2015)

| Original Plan | Revised Plan | Variance | |

|---|---|---|---|

| R&D Expense | 250 billion yen(+59%) | 280 billion yen(+78%) | +30 billion yen |

| Capital Expenditures | 330 billion yen(+71%) | 400 billion yen(+107%) | +70 billion yen |

| Depreciation & Amortization | 200 billion yen(+22%) | 210 billion yen(+28%) | +10 billion yen |

( ): vs. previous 3 fiscal-year (FYE2012 – FYE2014) period

Financial Policy

- Prioritize allocation of cash flows to investment for sustainable growth.

- Implement a well-balanced strategy with attention to investment efficiency, financial health, and shareholder returns

Shareholder returns

- Profits are returned to shareholders basically in the form of dividends with business results for each term, investment plans, and the business environment taken into account with the basic policy to provide continuous dividend payments which are linked to business performance of the company.

- Decide dividends for each fiscal year in view of circumstances, based on a consolidated dividend payout ratio of 20–40%.