Compliance

Our Approach

At SUBARU, compliance is positioned as one of our most important management issues in our Corporate Governance Guidelines. All officers and employees of the SUBARU Group are deeply ingrained with the commitment to adhere to the Compliance Manual, laws, internal regulations, and social ethics and norms, making it an integral part of their behavior at all levels. In the unlikely event of a violation of set standards, not only could the Company incur damages in accordance with legal regulations, but such incidents could erode the trust and confidence of customers, business partners, clients, shareholders, and broader society. Through the establishment and operation of a compliance system and organization, as well as various training activities, we are working to ensure that all employees have a strong awareness that thorough compliance throughout SUBARU forms the foundation of our management, and that each and every employee thinks about compliance, engages in dialogue, and takes action to permeate “Insightful Compliance.”

Rules for Compliance

In striving to enhance its compliance-related initiatives, SUBARU has established various rules related to compliance, including the Group-wide Risk Management and Compliance rules, which stipulate its compliance-related structures, organizations, and enforcement methods.

In pursuing our goal of “Delivering Happiness to All,” we have also established the Compliance Guidelines as a code of conduct to follow in daily business activities. Furthermore, the Compliance Manual (available in Japanese, English, and Chinese) has been prepared as a systematic manual for all SUBARU officers and employees to act in accordance with laws, regulations, compliance rules, and other internal rules, as well as social ethics and norms, and is disseminated to relevant parties. Furthermore, we have drafted the Compliance Manual: Essential Version to provide a clearer explanation of compliance.

Management System

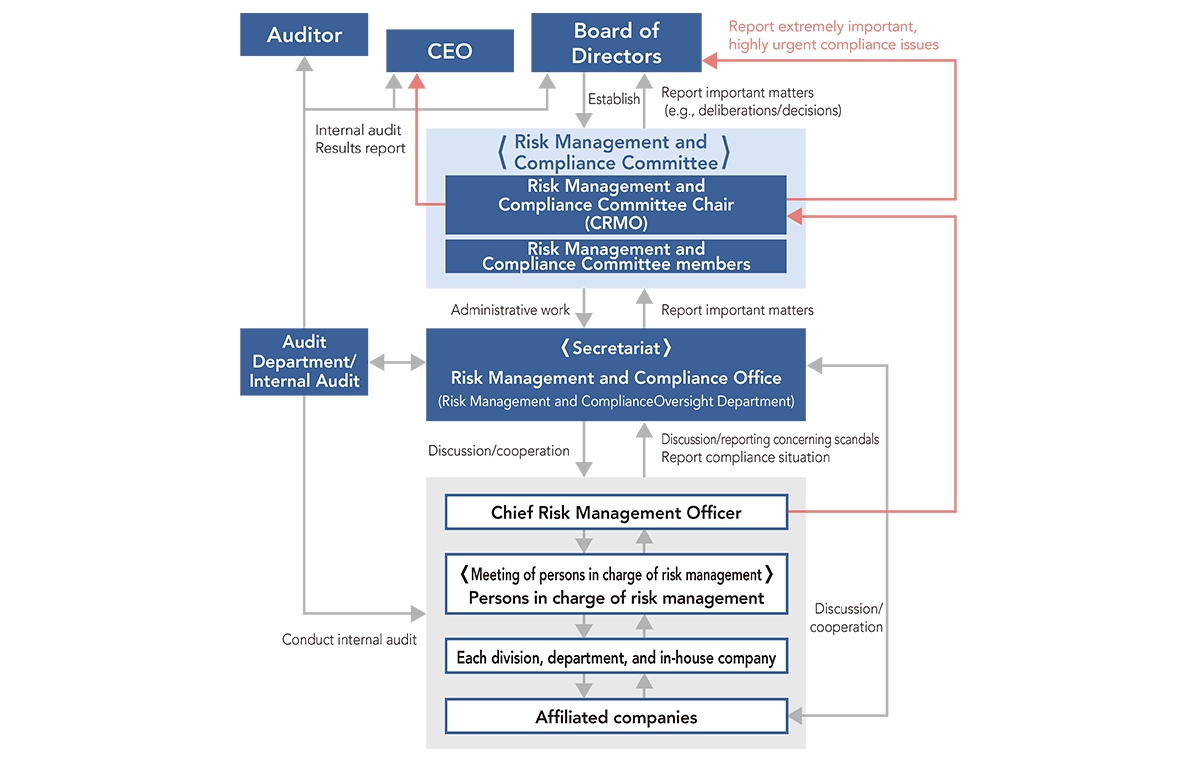

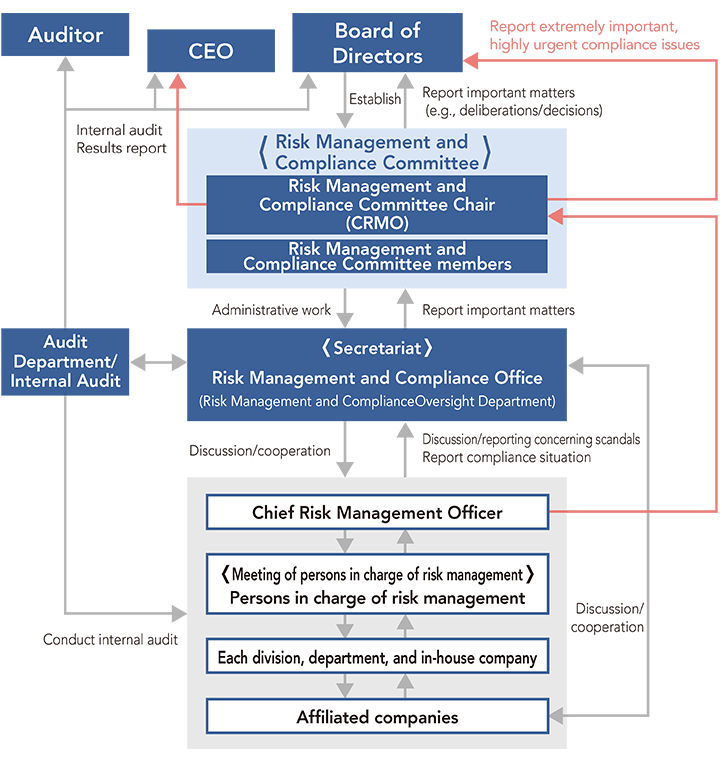

SUBARU has established the Risk Management and Compliance Committee as an organization designed to promote compliance. The Chief Risk Management Officer (CRMO), appointed by the Board of Directors, serves as chair of this committee, with the Risk Management and Compliance Office serving as its secretariat. Under the chair’s direction, the committee conducts comprehensive oversight of compliance and executes global and Group-wide compliance initiatives. In addition, the committee is responsible for the formulation of various policies, etc., and deliberating and deciding on important compliance matters, such as the status of Group-wide compliance activities and the operation of the internal reporting system, as well as for information exchange and liaison. The content of the committee’s activities is deliberated and reported on at meetings of the Board of Directors, which supervises the Risk Management and Compliance Committee. We also employ a PDCA cycle, with each department creating its own compliance program each fiscal year to enhance compliance. This involves consistent, structured independent actions for legal compliance management and to foster employee compliance awareness, as well as subsequent verification of compliance status.

Compliance System

Compliance Hotline

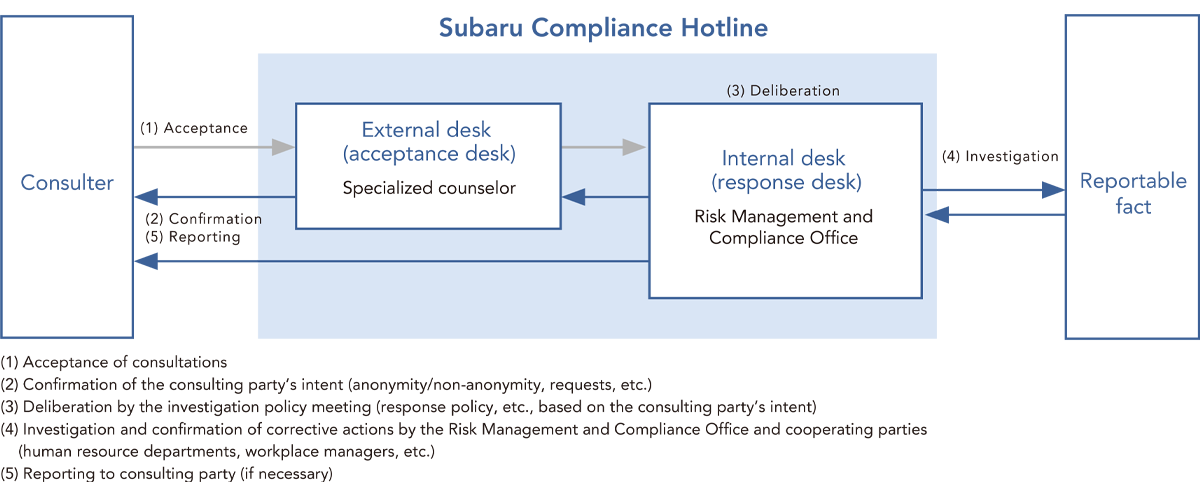

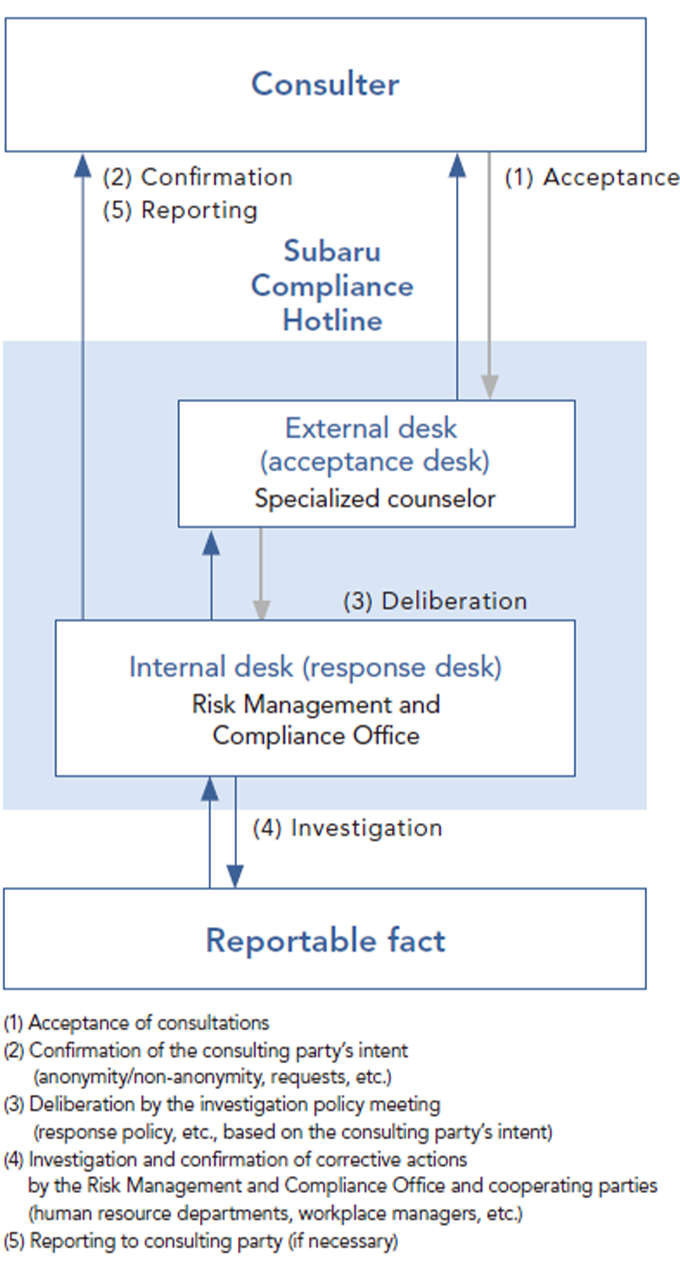

When regular or temporary employees of SUBARU and its Group companies in Japan detect a problem related to compliance in the Group, they can consult with our Internal Reporting Desk by using the Compliance Hotline.

The Internal Reporting Desk is staffed by employees designated as engaged persons under the Whistleblower Protection Act, who investigate and respond to reports received by telephone, websites, mail, and other methods. We have established a desk outside the Company staffed by external third-party specialists who have no conflict of interest to increase the hours in which service is available and to increase the confidentiality and security of those contacting the desk. Furthermore, we provide consultation services in four languages (English, Chinese, Portuguese, and Spanish) for foreign workers.

Consultations received through these channels are thoroughly examined by the Risk Management and Compliance Office General Manager, following our internal rules, to ensure swift resolution. Also, the Internal Reporting Desk reports to the proper management members and the Risk Management and Compliance Committee, working toward preventive measures through actions such as awareness-raising activities targeted through analysis and identification from incident trends. Moreover, we have established a mechanism that enhances the reliability and effectiveness of the internal reporting system by conducting third-party evaluations, led by legal experts, on reported cases and the subsequent actions taken.

Through initiatives to raise awareness of this system, SUBARU has improved awareness of compliance and fostered an atmosphere where employees can consult even about trivial matters, resulting in many consultations received. Since more than 80% of consultations are interpersonal relationship or labor-related, this system also contributes to corporate culture reforms as a desk for taking up and resolving workplace issues.

In FYE March 2025, we received 250 consultations. Of these, there were 23 suspected violations or violations of compliance, but none of these constituted serious violations. In addition, four of the 23 consultations involved conduct that was identified as harassment, such as abuse of power, but there were no cases of violations of the Labor Standards Act. Although these cases did not constitute serious compliance violations, we confirmed the facts of the major cases and took corrective measures such as alerting the relevant parties and re-educating them on procedures and rules.

We have also established internal reporting systems at our overseas Group companies.

In addition, we have established a separate consultation service for customer opinions and consultations regarding our products and services, as well as inquiries from our business partners. Please refer to the “Contact for Opinions and Consultation Services” section of “Respecting for Human Rights” for more information.

Compliance Hotline (Consultation and resolution procedure)

Breakdown of Compliance Hotline Consultations and Trend over Time

(Consultations)

| FYE March 2021 | FYE March 2022 | FYE March 2023 | FYE March 2024 | FYE March 2025 | |

|---|---|---|---|---|---|

| Suspected violation or violation | 19 | 26 | 24 | 34 | 23 |

| Labor-related grievances and requests | 65 | 67 | 59 | 52 | 34 |

| Interpersonal relationship grievances and requests | 143 | 111 | 178 | 219 | 169 |

| Others | 9 | 10 | 9 | 12 | 24 |

| Total | 236 | 214 | 270 | 317 | 250 |

Initiatives

Training

In enforcing thorough compliance, we believe that initiatives in which the entire SUBARU Group acts in concert are necessary. We conduct compliance training, training for legal affairs in practical business, and other programs for all employees of SUBARU and its Group companies in Japan organized by our Legal Department, Risk Management and Compliance Office, and human resource and education departments.

In FYE March 2025, SUBARU conducted compliance training for new employees, skilled employees, and those of manager level and above at the Aerospace Company.

In addition, to promote the understanding of key laws and regulations, the Legal Department leads training for legal affairs in practical business for SUBARU and employees of Group companies in Japan. In FYE March 2025, we conducted such training within nine programs covering topics that included various national security trade controls, the Act on the Protection of Personal Information, the Subcontract Act, and anti-monopoly laws outside Japan. In addition, to complement compliance enlightenment training, study groups are held at each department and affiliated company based on their compliance program, covering critical and important laws and regulations related to their work. These include export controls, the Act on the Protection of Personal Information, the Antimonopoly Act, the Political Funds Control Act, and harassment prevention.

Compliance Implementation Support Tools

In order to promote compliance in everyday work, we create and provide various implementation support tools other than the Compliance Manual, such as in areas of specialization at affiliated companies.

To make knowledge of the Compliance Hotline common, we distribute cards containing information on the framework of the system and the contact address for consulting services, and also put up posters in all workplaces. We have designed the information cards and posters to deliver a message that encourages employees to proactively use the system even for things that feel only slightly suspicious.

We are making efforts for the timely report of highly urgent information and to call all Group entities in Japan’s attention to such matters.

Bribery Prevention

At SUBARU, we consider the prevention of bribery in connection with our businesses as an important issue. We have established company-wide Bribery Prevention Rules and the following standards of conduct in the Compliance Guidelines, which we post and disseminate via our intranet, and are also implemented across our Group companies in Japan. We are committed to ensuring that specific actions are rigorously communicated and enforced through the Compliance Manual.

- Prohibition of providing, offering, or promising improper entertainment, gifts, favors, or other economic benefits to public officials or persons in similar positions, whether in Japan or abroad

- Prohibition of providing or receiving an amount in excess of socially accepted norms in dealings with business partners and customers who do not constitute public officials or similar persons

- Prohibition of receipt of personal gain as a result of using information obtained in the course of business, establishing boundaries between public and private life

To supplement the Compliance Guidelines and Group-wide Risk Management and Compliance Rules, SUBARU has also established the Company-wide Bribery Prevention Rules, which clarify prohibited and non-prohibited acts when dealing with public officials. Furthermore, SUBARU has established the Political Funding Company-wide Rules, which aim to ensure proper operation and execution of donations related to political activities by SUBARU in compliance with related laws and regulations, in order to control such donations.

SUBARU Group companies overseas have also established guidelines on anti-bribery in consideration of local laws and regulations to clarify the conduct required of employees and executives. In China, taking into consideration unique social conditions, we created the Bribery Prevention Guidelines (with a Chinese translation included). It is distributed throughout our Chinese subsidiaries and forms the official rules of the relevant companies. Also, anti-corruption is identified as an important issue in the Compliance Manual (available in Japanese, English, and Chinese) issued to Group companies in Japan and overseas. We not only require proper conduct regarding bribery to government workers but also pursue thorough fairness in transactions with private-sector customers and partners.

SUBARU has established the SUBARU Supplier CSR Guidelines, which clearly state our policy for preventing corruption, and requests that our suppliers also thoroughly implement fair trading practices in order to contribute to the implementation of CSR.

Under the monitoring system for bribery prevention, SUBARU collects information to ascertain the presence of cases that may constitute compliance violations through company-wide fact-finding investigations. It also strives to detect cases early via business audits conducted by internal audit departments. Furthermore, SUBARU has established a system to report high-risk cases to the Risk Management and Compliance Committee and the Board of Directors, in an effort to strengthen oversight.

In FYE March 2025, there were no fines, penalties, or settlement payments related to violations of anti-corruption laws and regulations within the SUBARU Group, and no individuals were subject to disciplinary dismissals for such violations.

Security Export Control

SUBARU, seeking to preserve the peace and safety of the international community, performs independent export control in accordance with the Foreign Exchange and Foreign Trade Act so that consumer products and technology that could be repurposed for military use, including weaponry, do not fall into the hands of countries developing weapons of mass destruction or terrorists (non-state entities). Group-wide regulations have been established for the purpose of appropriate management in this area, and the Export Control Committee meets at least once a year to deliberate on Group-wide initiatives. The committee is comprised of executives from all departments involved in exports, chaired by the executive in charge of the Legal Department.

With the goal of improving the level of its management and controls, SUBARU also promotes PDCA cycles, including review of related rules, with a focus on the following initiatives.

- Annual training for managers (including members of the Export Control Committee) by external experts and training twice a year for practitioners by the Legal Department (FYE March 2025 participants: 490)

- Export controls utilizing IT systems: regular system enhancements to improve controls/annual training to familiarize employees with the relationship between company-wide rules and systems (FYE March 2025 participants: 170)

- Strengthening audits by the Internal Audit Department in addition to self-audits by export-related departments and audits by the Legal Department

In addition, we are expanding our deemed export control management in departments that handle sensitive technologies to confirm compliance with not only the Foreign Exchange and Foreign Trade Act but also U.S. Export Administration Regulations and to ensure proper management.

Enactment of the Tax Policy

The SUBARU Group enacted its Tax Policy in June 2020. This basic policy sets forth our posture and way of thinking toward the tax laws we should comply with when paying the appropriate amount of tax.

In promoting tax strategy and risk management, SUBARU’s Finance & Accounting Department reports on these matters to the Chief Financial Officer (CFO), who must approve them before submission to SUBARU’s Executive Management Board Meeting and the Board of Directors. Such matters are also reported to the accounting auditors during their audits and to Audit & Supervisory Board Members upon request by the respective parties as appropriate.

SUBARU received a “Good” rating from the National Tax Agency for 2023 in relation to efforts to promote the enhancement of corporate governance on tax matters*.

- *

- Regarding the National Tax Agency’s policies for efforts to promote the enhancement of corporate governance on tax matters (Japanese version only):

https://www.nta.go.jp/taxes/tetsuzuki/shinsei/shinkoku/hojin/sanko/cg.htm

Tax Policy

The SUBARU Group is able to conduct its business operations thanks to support from society, and it strongly recognizes the importance of returning profits to society. The SUBARU Group considers fulfilling its tax obligations to be an essential element of this.

The SUBARU Group strives to ensure compliance with the tax laws and regulations of each country and jurisdiction, pursuant to the international rules and standards set out by international organizations, thereby fulfilling its social obligations through appropriate tax payment, while aiming for sustainable growth through sound business activities.

1. Compliance with tax laws and tax-related regulations

The SUBARU Group undertakes applicable tax return filing and tax payment procedures in compliance with the tax laws and tax-related regulations of each country, and relevant tax treaties.

2. Tax corporate governance

The SUBARU Group establishes and implements a structure to appropriately identify, manage and report tax risk. In order to respond to changes in its businesses, and in light of complex tax operations, the SUBARU Group enhances this structure by assigning to it employees with tax expertise. Furthermore, the SUBARU Group raises awareness and provides guidance and consultation regarding tax compliance to SUBARU Group companies, making use of external professionals, and properly fulfills its tax payment obligations.

3. Appropriate intercompany transaction prices (Transfer Pricing)

The SUBARU Group conducts inter-group transactions and transactions with unrelated parties applying economically rational (arm’s length) prices, and does not inappropriately set prices through arbitrary manipulation.

4. Compliance with Anti-Tax Haven Rules

The SUBARU Group does not establish entities that are unnecessary for its business with the aim of tax avoidance, and the SUBARU Group pays taxes pursuant to the substance of its businesses in accordance with the tax laws and regulations.

5. Relationship with tax authorities

The SUBARU Group strives to maintain trust with tax authorities by dealing with the authorities in a good faith manner; for example, by providing fact-based information in an appropriate and timely manner in response to requests.

Established in June 2020

Political Donations

No SUBARU employee shall make donations related to political activities to anyone other than political parties and political funding organizations. When providing support for activities of political funding organizations, we will respond appropriately in accordance with the Political Funds Control Act, the Public Offices Election Act, and other relevant laws and regulations.