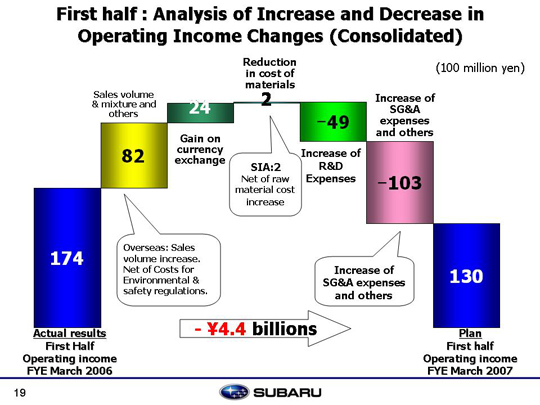

| Factors resulting in the drop in operating income from 17.4 billion yen to 13 billion yen are as follows: First, factors for increase include 8.2 billion yen which will be the result of the sales mix in particular. This figure includes an approximately 1 billion yen loss associated with improving specifications to meet environmental and safety regulations which could not be reflected in the sticker price. The 8.2 billion yen increase consists of minus 3 billion in Japan and 3 billion overseas. Also, inventory adjustments and others amount to about 8 billion yen, with improvements expected due to unrealized inventory exchange. An estimated foreign exchange gain of 2.4 billion yen is expected to be derived from exchange rate fluctuations with the yen moving down against the U.S. dollar by about 1 yen for 1.5 billion yen, remaining even with respect to the Euro and moving down against the Canadian dollar by about 6 yen for 0.6 billion yen. 0.3 billion yen will also be saved on shipments from SIA to Canadian subsidiaries due to a strong Canadian dollar against the U.S. dollar for a total of 0.9 billion yen. Cost reductions at SIA will amount to 0.2 billion yen. Overall cost reductions, although the revised FDR-1 is being carried out with top priority, are expected to be cancelled out for the most part during the first half by worsening market conditions caused by rises in raw material costs. Factors leading to profit decrease include a 4.9 billion yen increase in research and development expenses. These will increase for development of new models for FY2007 and beyond. SG&A expenses and others will increase to 10.3 billion yen, which includes a 1.9 billion reduction in fixed manufacturing costs. At SIA, die costs for the Legacy and B9 Tribeca will increase, but the same will drop domestically for minicars for an overall decrease. SG&A expenses will rise 7.2 billion yen over the previous year. In Japan, these will increase by 3 billion yen as advertising expenses rise with the introduction of new models at FHI. Advertising expenses at Subaru dealers in Japan will remain about the same as the previous year. An increase in expenses will also be seen at SOA, with incentives rising about US$100 per unit over the previous year and advertising expenses increasing by about 4 billion yen. Warranty expenses are expected to rise by 2.7 billion yen, and the remaining 2 billion yen will be found in other areas. Overall we expect operating income to drop by 4.4 billion yen. |