|

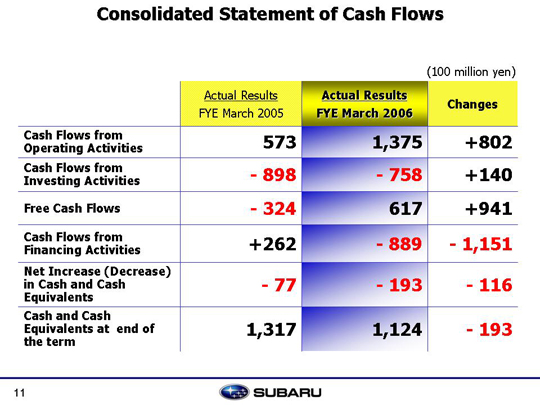

Operating cash flow was up 80.2 billion yen over the previous year. This was due largely to the 50.6 billion yen increase in profits (after adjusting for the increase in depreciation expenses and extraordinary losses). Additionally, there was a 26.4 billion yen cash increase due to a decrease of working capital (inventory, accounts receivable and accounts payable) as well as a 14.2 billion yen increase in fleet lease deposits and others, an 8 billion yen payment for premium retirement benefits while a 3 billion yen increase in corporate and other tax payments.

Investment cash flow was also up 14 billion yen over the previous year. This was due mainly to a decrease in investments for new car production facilities and an increase in collection of loans receivable.

Free cash flow as in the black at 61.7 billion yen, a 94.1 billion increase over the previous year.

Net cash used in financial activities was increased by 115.1 billion over the previous year as a result of repaying interest bearing debt (20.3 billion in corporate bonds, 3.4 billion in short-term loans, 26.4 billion in long-term loans and 26 billion in commercial papers compared to the same period in the previous year) and buying back the company's own shares (39.4 billion yen) after dissolving the capital alliance with GM.

Cash on hand decreased by 19.3 billion yen to 131.7 billion yen at the end of the term.

|