|

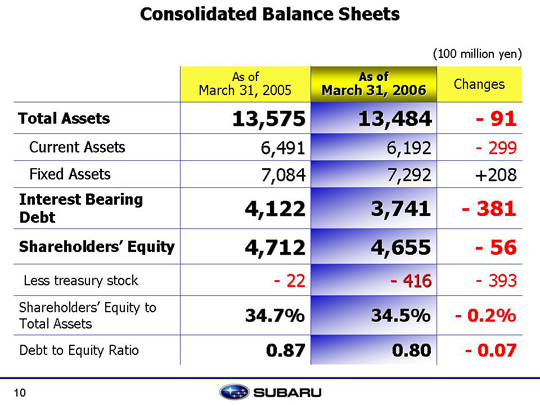

Total assets dropped 9 billion yen compared to the previous year to 1.3484 trillion yen. The major factors behind the 29.9 billion yen decrease in current assets were the reduction of marketable securities in preparation for the share buy back last October and liquidation of 10 billion yen of the financial subsidiary's assets as part of the asset streamlining activities planed in the revised FDR-1. As for interest-bearing debt, a 10 billion yen straight bond was redeemed, and 14 billion yen in commercial papers issued by our subsidiary, Subaru Finance Co., Ltd., were repaid. This led to a 38.1 billion yen year-on-year decrease to a total of 374.1 billion yen. The debt to equity ratio is 0.80. 3.2 billion yen was amortized for the consolidated adjustment account in relation to SIA�s payment of fixed costs, and 7.1 billion yen of the settlement with Isuzu was written off. In shareholders� equity, while there was 7 billion yen of dividends paid, this was offset by 3.5 billion yen in retained earnings from new equity method affiliates. Current net income was at 15.6 billion yen, and retained earnings increased by 12 billion yen. As a result of the share buyback following the dissolution of the strategic alliance with GM in last October and the initiation of a new business alliance with Toyota Motor Corporation (Toyota), the treasury stock increased by 39.3 billion yen to 41.6 billion yen. Additionally, losses in the translation adjustment account have declined owing to the weak yen, so that the overall total for shareholders� equity was at 465.5 billion yen. Shareholders� equity to total assets dropped by 0.2% to 34.5% as a result of the share buyback and foreign currency transaction adjustment. |