|

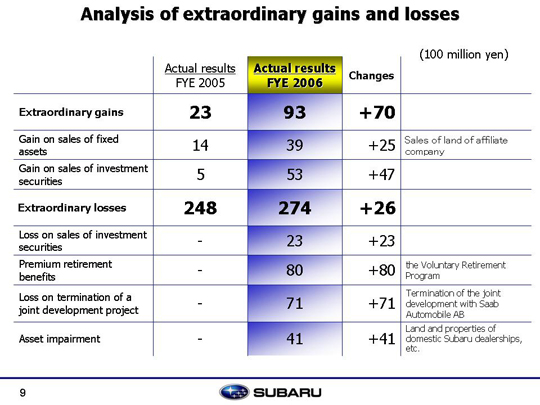

As for extraordinary gains, there was about a 3 billion yen gain on the sales of fixed assets with the sales of land by an affiliated company which was done partially ahead of schedule. There was also approximately 5 billion yen (a cash inflow of 11.9 billion yen) from the gain on sales of investment securities in preparation for the share buyback in last October. An extraordinary loss of 27.4 billion yen was also posted. The dissolution of the joint venture agreement with NEC Corporation, which had been developing a lithium ion battery, resulted in a 2 billion yen loss on sales of investment securities.There was also a loss of 3.6 billion yen resulting from the termination of joint development with Saab Automobile AB (Saab) due to the dissolving of the alliance with General Motors Corporation (GM) and a 3.5 billion yen loss due to cancellation of SCM development resulting in a combined total of 7.1 billion yen. Furthermore, application of asset-impairment accounting resulted in a 4 billion yen loss associated mainly with land and properties owned by Subaru dealerships in Japan. There was also an expenditure of 8 billion yen for premium retirement benefit allowances for employees leaving the company under the early retirement program which was offered in last December. |