|

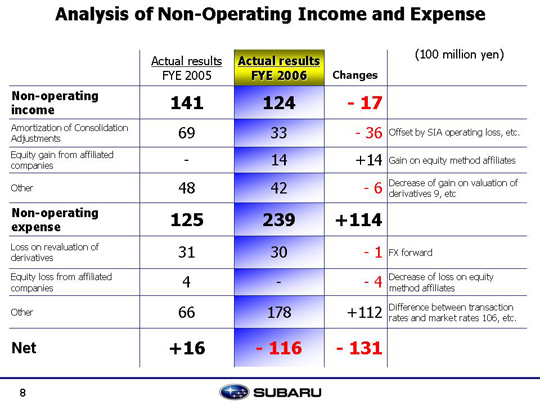

Major factors accounting for the difference in non-operating income compared to the previous year:

Amortization in the consolidation adjustment account decreased 3.6 billion yen, which canceled out the operating costs associated with the fixed costs incurred as a result of Isuzu retreat from SIA. An increase of 1.4 billion yen in equity gains from affiliated companies represents earnings of 11 equity method affiliates (six of which are new). Other factors include a 0.9 billion yen decrease in exchange gains and an increase of 0.5 billion yen in the gain on valuation of derivative related currency options.

Major factors accounting for the difference in non-operating expenses compared to the previous year:

The 0.1 billion yen decrease in loss on revaluation of derivatives was a result of 0.7 billion increase in loss on revaluation of forward exchange contracts and 0.8 billion yen decrease in loss on revaluation of the currency options. Other non-operating expenses include a 10.6 billion yen foreign exchange loss.

Net of non-operating income and expense resulted in a 13.1 billion yen decrease compared to the previous year. This decline arose from the 10.9 billion yen related to exchange and the 3.6 billion yen decrease in consolidated adjustment account and a 1.8 billion yen investment return by the equity method.

|