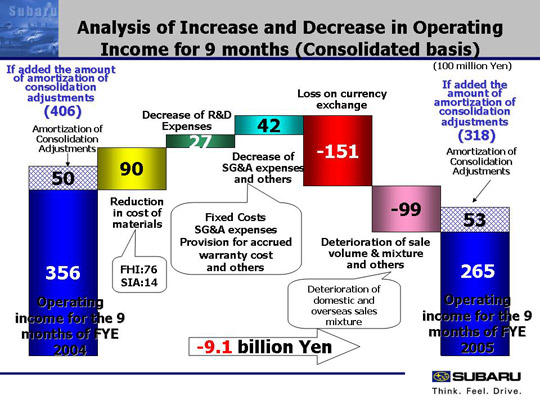

| Here are some more details about the analysis of increase and decrease in changes of operating income from 35.6 billion yen to 26.5 billion yen. Factors leading to profit increase; Reduction in cost of materials was 9 billion yen, of which FHI accounted for 7.6 billion yen and SIA 1.4 billion yen. R&D expenses decreased 2.7 billion yen from 42.7 billion yen to 40 billion yen. Decrease of SG&A expenses and others was 4.2 billion yen. Contributed to that were around negative 4 billion yen in the increase in manufacturing fixed costs, of which negative 3.4 billion yen in the increase in fixed costs following the startup of the new Legacy at SIA, and negative 7 hundred million yen from the depreciation of the dies etc.at FHI. Isuzu’s commission income from consignment production of Isuzu cars decreased by approximately 1 billion yen. But this were compensated by decrease of several hundreds of millions of yen in SG&A costs and decrease of warranty costs of which 7.6 billion yen from the decrease in allowances and 2.4 billion yen from the decrease in product warranty. Factors leading to profit decrease; Loss on currency exchange was negative 15.1 billion yen, most of which derived from the Yen/US dollar exchange transaction. Deterioration of sales volume and mix was negative 9.9 billion yen. The domestic portion was approximately negative 8 billion yen. The sales volume has increased due to the launch of new model, R2, but the product mix deteriorated. Deterioration in the overseas product mix accounted for losses of several hundred million yen. Inventory adjustment accounted for losses of approximately 3 billion yen, and components and others gains of 1 billion yen. Therefore, 9.1 billion yen decreased from the corresponding period of previous year. |