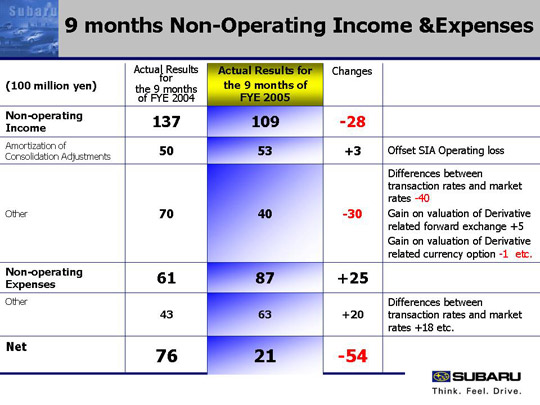

| Non-operating income and expenses decreased year over year by 5.4 billion yen. The main cause of the difference in non-operating income and expenses year over year was a 3 hundred million yen increase from 5 billion yen to 5.3 billion yen in amortization of consolidation adjustments, which offset an increase of the overhead that occurred from consignment production of Isuzu vehicles at SIA. Other factors were almost related to the currency exchange. First, the forward foreign exchange rate was used until the previous fiscal year to post sales denominated in foreign currency. Therefore, 4 billion yen consolidated translation adjustment caused by the differences between transaction rates and market rates stated in non-operating income in 9 months of the previous fiscal year turned negative in the current fiscal year. Second, due to the change of accounting policy, approximately 5 hundred million yen was posted due to the appraisal gain of derivatives for forward exchange contracts (referring to Consolidated 3rd Quarter Financial Results for Fiscal 2005, P1, item 1.(2)). Third, the gain on valuation of derivative related currency options decreased 1 hundred million yen (8 hundred million to 7 hundred million) year over year. Another main factor in the difference in non-operating expenses comes under the “Other” heading. Since the market rates was used to post all sales denominated in foreign currency, the difference between the averages market rate of the period and the transaction rates of forward exchange contract resulted in loss of approximately 1.8 billion yen as a consolidated translation adjustment. |