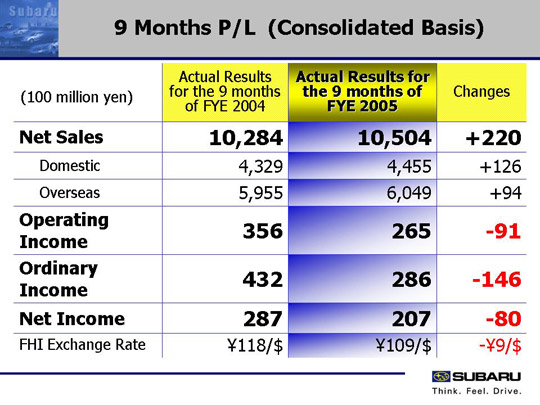

| Net sales of the first 9 month of this fiscal year increased by 22 billion Yen due to the increased sales volume of automobiles both in the domestic and overseas markets. Improves product mixture in overseas and the increased sales revenue from other businesses also contributed and made up for foreign exchange rate related losses. More details will be provided later, but operating income for this 9 months period fell by 9.1 billion Yen to 26.5 billion Yen year over year despite our efforts to absorb foreign exchange rate losses caused by appreciation of the yen through cost reductions, streamlining R&D expenses and other overhead. Ordinary income also fell by 14.6 billion Yen year over year to 28.6 billion Yen. I shall also explain later about the impact of the exchange rate, which was the main cause regarding the fluctuation of non-operating income and expenses. During this period, net income likewise fell 8 billion Yen to 20.7 billion Yen. In extraordinary gains, the gain on sale of investment securities and its prior period adjustment, which were stated in the previous fiscal year, did not accrue in the current fiscal year. However, because of the termination of Isuzu’s consignment production, an additional 2.5 billion Yen in extraordinary gains accrued. This amount was the balance after offset of SIA’s actual losses incurred from expenses of capital lease and others with the amortization of consolidation adjustments arisen when SIA became a wholly owned subsidiary of Fuji Heavy Industries Ltd. |