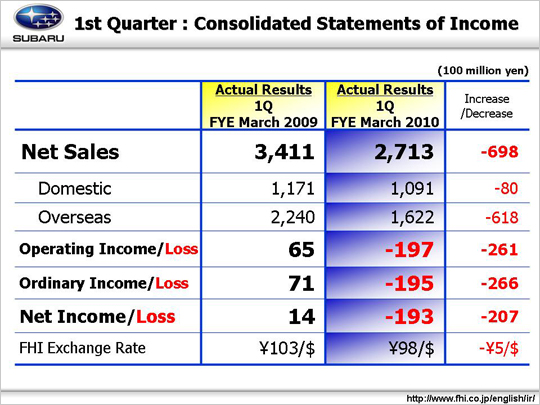

For the term ending in March 2010, the sales revenue in the 1st quarter fell to 69.8 billion yen. Domestic and overseas sales volume and mixture deteriorated to 53.9 billion yen, and loss on currency exchange for the $US, $CA, and Euro worsened to 16.6 billion yen due to the strong yen, so that 700 million yen in increased sales from the three internal companies could not make up the difference. Operating income will be discussed in detail later, but while efforts were made to make up for the strong yen and deterioration in sales volume and mixture by drastically cutting costs for SG&A and other expenses, the cost of materials, and R&D, they were unable to compensate, so the operating income fell 26.1 billion yen to an operating loss of 19.7 billion yen. Ordinary income for a year-on-year basis fell 26.6 billion yen to an ordinary loss of 19.5 billion yen. The gain on valuation of derivatives counterbalanced the FOREX loss. There was nothing particularly outstanding in extraordinary income and loss. |