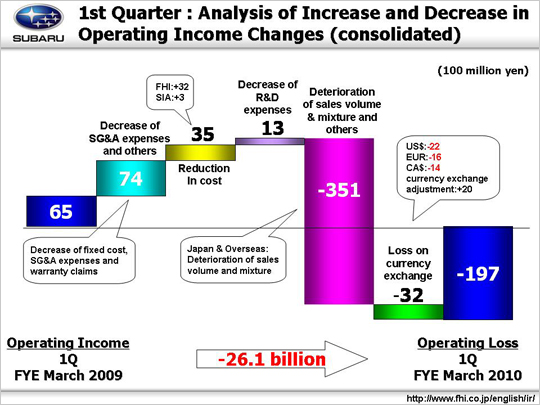

Next is an explanation of the factors contributing to changes in operating income, from an operating income of 6.5 billion yen to an operating loss of 19.7 billion yen.

The 7.4 billion yen increase in profit stemmed from a decrease in SG&A expenses and others, which can be attributed to 3 factors: 1. Fixed costs were decreased 1.9 billion yen (FHI: +100 million yen, SIA: +1.8 billion yen ), among that, fixed processing cost at FHI fell to +1.1 billion yen, while expenses of suppliers’ dies increased to -1 billion yen. At SIA, costs dropped US$17M, stemming from expenses of suppliers’ dies reduction of +$16M and fixed processing cost of +$1M.

2. In addition, SG&A expenses decreased to yield +4.7 billion yen. At FHI (+4.1 billion yen), efforts were made to reduce advertising and administration expenses, and domestic dealers (+2.2 billion yen) also worked to cut administration expensed. On the other hand, at SOA (-2.2 billion yen, US$21M), advertising expenses (-$7M) and incentives increased (-$14M, $1,800 → $2,000 per unit) . However, at Canadian subsidiaries, advertising expenses were reduced (+100 million yen), and other subsidiaries (+500 million yen) also made efforts to reduce overhead costs.

3. Cost associated with the warranty claims were down, resulting in +800 million yen.

The reduction in material cost led to +3.5 billion yen—in FHI +3.2 billion yen and in SIA +300 million yen. At FHI, among 3.2 billion yen of the cost reduction, +2.8 billion yen was pure cost reduction and the material price down was +400 million yen, which was the reversal of precious metals price, rise in the previous fiscal year. Pure cost reduction at SIA led to +400 million yen, and the impact of the high price of raw materials brought -100 million yen.

Reduced R&D expenses resulted in +1.3 billion yen (9.7 billion yen → 8.4 billion yen). Efforts are being made to conduct efficient R&D.

Factors decreasing profit, such as deterioration in sales volume and mixture led to -35.1 billion yen, which can be broken down into 3 areas: 1. domestic at -4.8 billion yen, 2. overseas at -20.7 billion yen—production adjustment and reduction in shipped units at FHI had a particularly big impact, and 3. unrealized inventory loss and others at -9.6 billion yen.

The loss on currency exchange was -3.2 billion yen. The strong yen brought approx. 5 yen to the dollar yielding -2.2 billion yen, while the EUR brought approx. 29 yen for -1.6 billion yen. The Canadian dollar brought approx. 22 yen, yielding -1.4 billion yen. This 1st quarter includes +2 billion yen currency exchange adjustments between FHI and overseas subsidiaries, which used to be classified as “SG&A and other expenses” before. The currency exchange rate at FHI is the monthly average rate of the previous month, however, the subsidiaries’ exchange rate is the spot rate. Therefore the difference between the FHI’s sales rate and the subsidiaries’ purchasing rate must be adjusted.

As noted above, operating income fell 26.1 billion yen to the operating loss of 19.7 billion yen. |