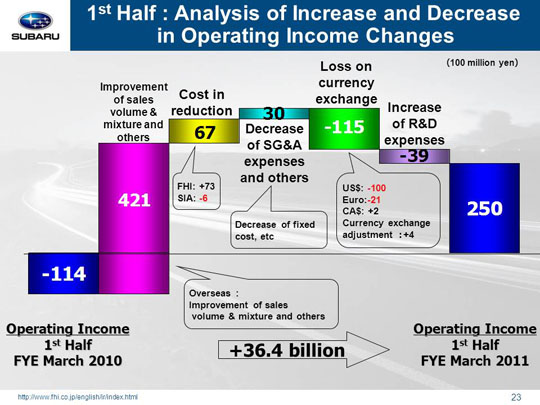

Now let’s look at why we expect a year-on-year increase of 36.4 billion yen in operating income for the first half that will take us from an operating loss of 11.4 billion yen to a gain of 25.0 billion yen.

We forecast an operating income gain of 42.1 billion yen resulting from a much better sales volume and improvement of mixture. This gain will include: (1) a loss of 3.8 billion yen in the domestic market; (2) a 42.1 billion yen gain overseas that will be fueled by increased sales along with the exports from FHI; and (3) an estimated gain of 3.8 billion yen related to inventory adjustment and others.

Cost cutting measures will realize an overall gain of 6.7 billion yen, including a gain of 7.3 billion yen at FHI and a loss of 0.6 billion yen at SIA. FHI is expected to generate a gain of 10.7 billion yen with a loss amounting to 3.4 billion yen due to increased costs for precious metals and other market related materials. SIA is expected to generate a gain of 2.6 billion yen and a loss of 3.2 billion yen related to rising material prices including precious metal and other market related ones.

We expect to gain 3.0 billion yen from lower SG&A expenses and others. (1)This gain includes a reduction in fixed manufacturing costs that will reap gains of 4.6 billion yen in total, with a gain of 5.0 billion yen at FHI and a loss of 0.4 billion yen at SIA. The gain at FHI is expected to come from the reduction in fixed processing costs of 1.4 billion yen and expenses for suppliers’ dies of 3.6 billion yen. SIA will gain 0.5 billion yen due to cost cuts for suppliers’ dies and loss of 0.9 billion yen due to increased processing costs. (2) An increase in SG&A expenses is projected to yield a total loss of 6.5 billion yen, with a loss of 4.3 billion yen at FHI and a gain of 1.7 billion yen at domestic dealers due to reduced SG&A expenses. SOA as a whole will generate a loss of 2.8 billion yen, including a 0.5 billion yen gain from reduced advertising and SG&A expenses on top of a loss of 3.3 billion yen related to sales incentives. The per unit incentive during the first half of FY 2011 is expected to remain at 1,300 dollars with the same level of the first half of FY2010, though the total amount of incentives will be increased as sales expected to grow in volume. Our Canadian subsidiary is projected to generate a loss of 1.1 billion yen. (3) We estimate that cost reductions related to warranty claims will bring gains totaling 5.2 billion yen. (4) Increases in other expenses will generate a loss of 0.3 billion yen.

Foreign exchange rate fluctuations are expected to bring operating income down 11.5 billion yen. This includes a loss of 10.0 billion yen due to an approximate six yen appreciation against the US dollar, a loss of 2.1 billion yen due to an approximate 13 yen appreciation against the euro, and a gain of 0.2 billion yen due to an approximate one yen depreciation against the Canadian dollar. This figure also includes a gain of 0.4 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries.

We also expect a loss of 3.9 billion yen due to an increase in R&D expenses (from 17.1 billion yen to 21.0 billion yen) for developing new models and more environmentally friendly features.

These factors combined will bring operating income up 36.4 billion yen to total 25.0 billion yen.

|