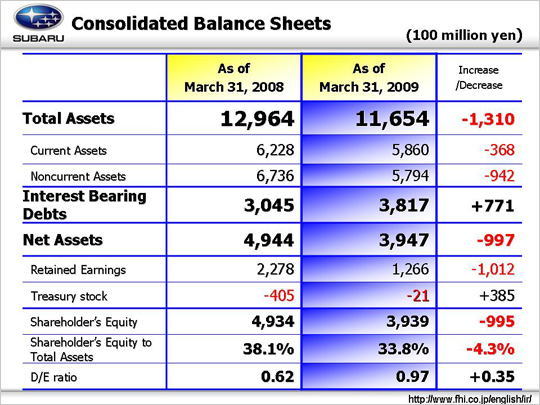

| The balance sheet shows total assets decreasing by 131 billion yen to 1,165.4 billion yen from the end of the previous fiscal year. A decrease of roughly 50 billion yen was due to the impact of foreign exchange fluctuations. Both current and noncurrent assets decreased as a result of the provision of valuation allowance of deferred tax assets. Interest-bearing debts increased 77.1 billion yen to total 381.7 billion yen. Although 30 billion yen in bonds payable were redeemed, commercial papers were increased by 18.0 billion yen and long-term loans payable including those payable within a year were also increased by about 30 billion yen at the time of the fourth quarter inventory adjustment in order to increase reserves for working capital. Retained earnings were down 101.2 billion yen on a year-on-year basis. Factors for this decrease include a net loss of 69.9 billion yen for FYE March 2009, a loss of 5.2 billion yen as a result of adjusting the net losses of SOA and SIA for the period from January to March 2009 in order to align their end of the fiscal year accounts with FHI’s, and the amortization of goodwill in the amount of 12.6 billion yen for the purpose of aligning overseas subsidiaries’ accounting standards with Japanese accounting standards. Shareholders' equity also decreased 99.5 billion yen. These results brought the shareholders’ equity to total assets ratio to 33.8% and the debt-to-equity ratio to 0.97. |