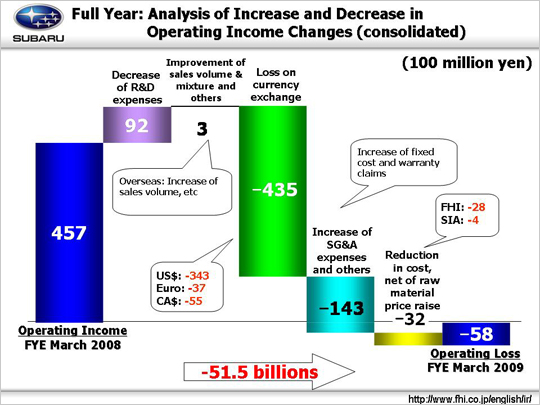

| Let’s look at why the operating income went from 45.7 billion yen to minus 5.8 billion yen. We gained 9.2 billion yen due to a reduction in R&D expenses (from 52 billion yen to 42.8 billion yen). R&D expenses were pared down since we once completed the development of new models and streamlined advanced research costs. We gained 0.3 billion yen due to improvement of sales volume & mix. This amount can be broken down into three areas: (1) a decrease of 13.7 billion yen due to the deteriorated domestic sales volume and mix; (2) a decrease of 3.3 billion yen in overseas markets; and (3) an increase of 17.3 billion yen in others. We saw a decrease of 43.5 billion yen coming from foreign exchange losses. A fourteen-yen appreciation against the U.S. dollar resulted in an exchange loss of 34.3 billion yen. A fourteen-yen appreciation against the euro and a twenty-yen appreciation against the Canadian dollar resulted in exchange losses of 3.7 billion yen and 5.5 billion yen respectively. We lost 14.3 billion yen due to increase of SG&A expenses and others. This can be divided into four factors. (1) An increase in fixed costs resulted in a loss of 10.1 billion yen (-11.2 billion yen for FHI, +1.1 billion yen for SIA). FHI saw an increase in fixed processing costs (-6.8 billion yen) due to the new model launches and an increase in expenses for suppliers’ dies (-4.4 billion yen). At SIA an increase in labor costs (+$9M) was offset by decreases in expenses for suppliers’ dies and depreciation expenses (+$24M from decreased expenses for suppliers’ dies,+$3M from decreased depreciation, -$11M from increased labor expenses and -$7M from increased overhead). (2) The decrease in SG&A expenses resulted in a gain of 2 billion yen. SG&A expenses were reduced at both FHI (+8.6 billion yen) and domestic dealers (+3.8 billion yen). An increase in advertising costs at SOA resulted in a loss of 0.5 billion yen [-$3M (+$7M due to decreased incentives, -$10M due to advertising costs, +$3M due to market development expenses, and -$3M due to SG&A)]. An increase in SG&A expenses in Canada resulted in a loss of 2.5 billion yen. Another loss of 4.3 billion yen was generated as a result of the consolidation of new subsidiaries. There was also an additional decrease of 3.1 billion yen due to other reasons. (3) An increase in costs associated with warranty claims led to a loss of 3.9 billion yen. (4) A loss of another 2.3 billion yen was due to foreign exchange adjustments for procurements at subsidiaries. We lost 3.2 billion yen in total, 2.8 billion yen at FHI and 0.4 billion yen at SIA, due to a hike in raw material prices despite a reduction in cost of materials. This drop includes a loss of 20.6 billion yen due to a hike in raw material prices (16.5 billion yen at FHI and 4.1 billion yen at SIA). Cost of materials was reduced by 17.4 billion yen in total, 13.7 billion yen at FHI and 3.7 billion yen at SIA. These factors combined brought operating income down 51.5 billion yen. |