|

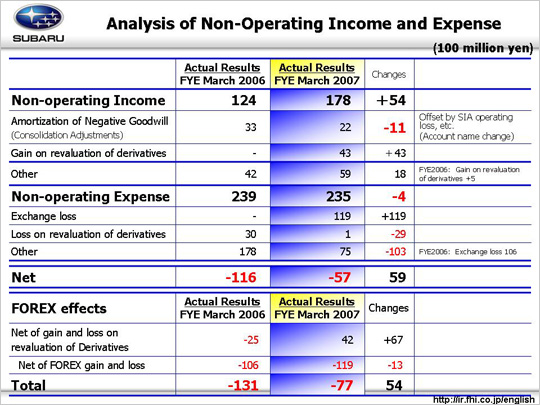

A net non-operating income and expense increased by 5.9 billion yen from the previous fiscal year.

The primary causes for the difference in the non-operating income were as follows:

Amortization of consolidated adjustments offset the increased burdens of joint expenses, which SIA bore after the withdrawal of Isuzu. This amortization fell 1.1 billion yen (from 3.3 billion yen to 2.2 billion yen). From the fiscal year ended March 31, 2007, the title of this item was changed to the amortization of negative goodwill, and this was completed at this period.

Foreign exchange has the largest impact to the net non-operating income and expense. The effects of foreign exchange are divided into: (1) Gains and losses on revaluation of derivatives, and (2) Foreign exchange gains and losses. Compared to the previous fiscal year, (1) Gains and losses on revaluation of derivatives for the year ended March 31, 2006 decreased by 2.5 billion yen, which is the net of +0.5 billion yen higher gain on revaluation of derivatives which was included in Others item of the net non-operating income, and 3.0 billion yen greater loss on the revaluation of derivatives in the non-operating expenses. For the year ended March 31, 2007, there was a 4.3 billion yen gain on revaluation of derivatives, and 0.1 billion yen loss on revaluation of derivatives, which nets to 4.2 billion yen gain, and that is a 6.7 billion yen improvement over the previous year. (2) On the other hand, for foreign exchange losses, the market / hedge rate difference (117/112) resulted in a loss of 11.9 billion yen, which was 1.3 billion yen less than the previous year, when (112/108) resulted in a loss of 10.6 billion yen in previous fiscal year. The total effect of foreign exchange improved 5.4 billion yen over the previous year.

The actual reduction in the effect of foreign exchange (-7.7 billion yen) comprised the majority of the 5.7 billion yen difference between the operating profit (47.9 billion yen), and the ordinary profit (42.2 billion yen).

|