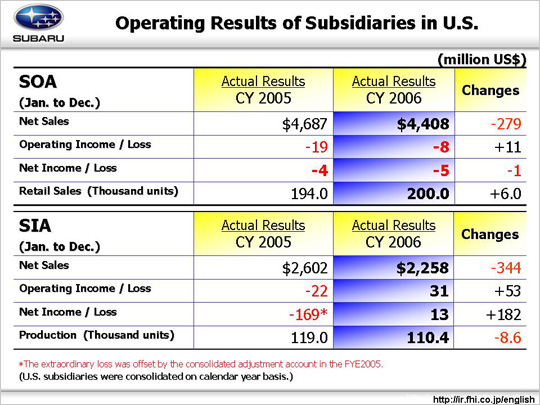

For Subaru of America, Inc. (SOA), although retail unit sales rose thanks to the strengthened Impreza sales, due to the dealerships inventory adjustments focused on the B9 Tribeca, net sales were down by $279M from the previous calendar year. Operating losses worsened based on deterioration of sales volume and mixture mainly due to the inventory adjustments at the dealerships (-$40M), increased incentives (-$50M) {2005: $1,450 to 2006: $1,800}, and higher advertising costs (-$13M), etc. However, due to changes in purchasing prices from FHI and SIA considering a competitive strength in the U.S. market, the operating loss was improved (+$11M) over the previous year. |