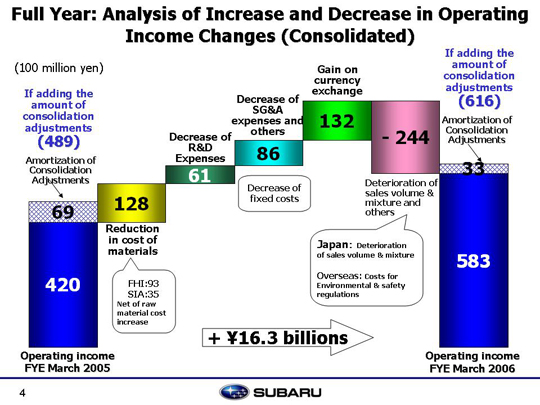

Explanation of factors leading to increase in operating income, which went from 42.0 billion to 58.3 billion yen

Factors leading to profit increase:

Cost of materials was cut by 12.8 billion yen--9.3 billion at Fuji Heavy Industries Ltd. (FHI) and 3.5 billion at SIA. This was net of the cost of steel and other materials went up about 11 billion yen due to worsening market conditions. Research and development spending was reduced by 6.1 billion yen, due in part to efficient R & D operations for new minicar and the Impreza FMC, in addition to the completion of development on the B9 Tribeca and cancellation of development on the new platform. SG&A expenses and others were reduced by 8.6 billion yen. Fixed manufacturing costs were reduced by 10.6 billion yen. Although fixed costs rose due to the launch of the new model at SIA and increases in the depreciation costs for the Legacy and B9 Tribeca dies, these were offset by a decrease in depreciation costs for the FHI Legacy dies. Meanwhile, SG&A expenses rose by 0.3 billion yen. This was due to an increase in advertising costs and incentives at Subaru of America, Inc.(SOA), even though advertising costs and sales incentives were decreased at FHI and Subaru dealerships in Japan. Warranty claims were reduced by 1.9 billion yen, and the remainder was due to other factors.

Currency exchange gains totaled 13.2 billion yen. There was an approximately 4 yen drop in the yen against the U.S. dollar, which resulted in 9.6 billion yen gains. The appreciations of the Canadian dollar against the Yen and the U.S. dollar had a positive impact of a 3.2 billion yen in total. An approximately 10 yen drop against the Canadian dollar generated the positive effect of a 1.8 billion yen gains. The strong Canadian dollar had positive effects on shipment from SIA to the Canadian subsidiary by 1.4 billion yen gains. There was an approximately 2 yen drop in the yen against the Euro, this resulted in 0.4 billion yen gains.

Factors leading to profit decrease:

A 24.4 billion yen loss was suffered due a deterioration in the sales volume and mixture. This amount included a loss of 18.8 billion yen in domestic sales due largely to a significant decline in the sales volume of the Legacy and R2 as well as the unfavorable sales mixture for the Legacy. Overseas, the loss was 1.9 billion yen. This includes a 12.0 billion yen loss in FHI sales due to costs associated with improving specifications to meet environmental and safety regulations which could not be reflected in the sticker price. Inventory and other adjustments resulted in a decrease of 3.7 billion yen.

These factors combined led to an increase of 16.3 billion yen in operating income.

|