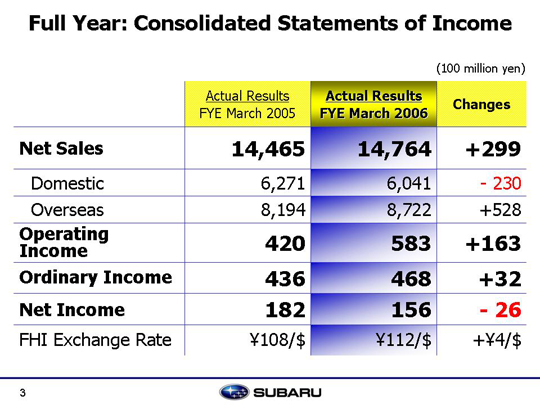

Sales for the period ended March 31, 2006 were up 29.9 billion yen. The 24.3 billion yen decline in revenue due to the discontinuation of consignment production for Isuzu at SIA was offset by the 19.2 billion increase in sales among the three internal companies as well as the increase in the number of units sold and improvement of the sales composition overseas. Operating income will be discussed in more detail later, but briefly stated, the effects of the worsening domestic and overseas sales mix were lessened by reducing costs and overhead and improving the efficiency of R&D activities, resulting in an increase of 16.3 billion yen to reach 58.3 billion yen. This was roughly 9 billion yen higher than the 49 billion yen estimate from the 3rd quarter, as the exchange rate shifted to a weaker yen, and favorable inventory adjustment due to reduction in overseas inventory. Ordinary income was also up by 3.2 billion yen compared to the previous year at 46.8 billion yen. These details will also be explained later, but in summary, this was 8 billion yen higher than the 3rd quarter estimate of 39.0 billion yen. Current net income was at 15.6 billion yen thanks to an extraordinary gain which helped to top the third quarter estimate of 12.0 billion yen. |