|

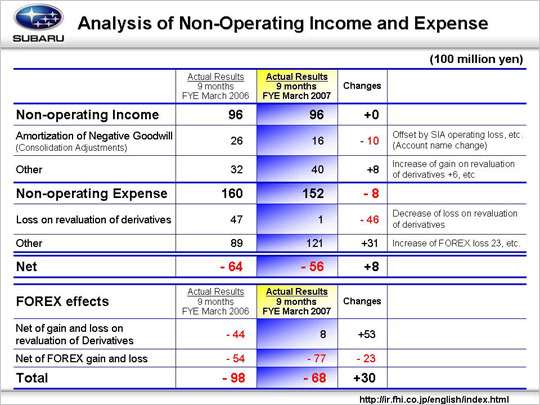

Net of non-operating income/expense increased by 0.8 billion yen on a year-on-year basis.

The primary factors of the decrease from last year in non-operating income can be broken down as follows:

Counterbalancing the increased fixed cost burden of SIA following the withdrawal of Isuzu, the amortization of consolidated adjustment decreased by 1.0 billion yen from 2.6 billion yen to 1.6 billion yen. Since the current term, the title of this item has been changed to the amortization of negative goodwill. The SIA-related amortization of negative goodwill for the fourth quarter is projected to be around 0.5 billion yen, with a total amortization amount of approximately 2.0 billion yen scheduled for completion for this fiscal year.

Foreign exchange is having the most significant effects on the net result in non-operating income/expense. The reasons are two-fold: [1] Net gain /loss on the revaluation of the derivatives and [2] Net foreign exchange gain and loss. Compared to the same period of last fiscal year, [1] this term is heading toward a net gain of 5.3 billion yen, with the gain on the revaluation of the derivatives of 0.6 billion yen increase in non-operating income (including in item of “other”), and a loss on the revaluation of the derivatives of 4.6 billion yen decrease in non-operating expense. [2] Foreign exchange gain or loss has seen a loss of 2.3 billion yen from the same period of last fiscal year based on the differential between market and hedge rates (116/111). Overall, foreign exchange effects are heading toward a gain of 3.0 billion yen from same period of last fiscal year.

However, the actual foreign exchange effect of a 6.8 billion yen loss for 9 months by the third quarter consists primarily of the 5.6 billion yen differential between the 35.8 billion yen in operating income and 30.2 billion yen in ordinary income.

|