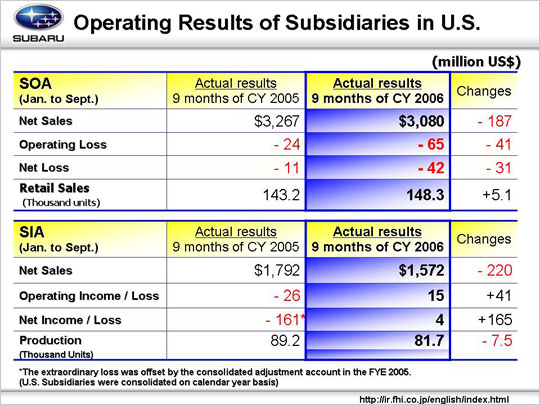

SOA retail sales results for 9 months show strong sales of the Impreza boosted the total sales volume by 5.1 thousand units on a year-on-year basis. However, dealer inventory adjustments saw net sales revenue decrease by $187 million. Operating losses increased by $41 million on a year-on-year basis to $65 million due to a $55 million increase in incentives and a $14 million increase in advertising costs along with a repositioning of MSRP in line with competition in the U.S. market. Net losses likewise jumped by $31 million from the same period last year to $42 million. SIA saw a drop of $220 million in sales along with a production volume decrease of 7.5 thousand units during 9 months. At the profit level, there were factors leading to a profit decrease such as a reduction in units shipped ($13 million) and increases in the depreciation of dies for the B9 Tribeca ($7 million), combined with material price rises and buoyant market ($29 million). However, there were offset by such positive factors as reductions in material costs ($24 million, gross $53 million), labor and overhead costs reduction ($3 million) as well as cost depreciation decrease ($7 million) and improved price mix ($27 million). This all resulted in an increase of $41 million on a year-to year basis to $15 million in operating income. Net income totaled $4 million, with a profit increase of $165 million due to the write-off of extraordinary losses generated from the cancellation of leased facilities as a result of the termination of consignment production in March 2005.

|