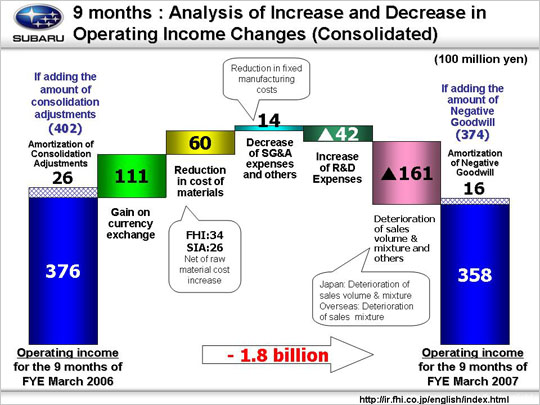

Now moving on to the reasons for the change in operating income from 37.6 billion yen to 35.8 billion yen.

An increase of 11.1 billion yen was due to foreign exchange gains. There was an approximate six-yen depreciation against the US dollar for a gain of 7.6 billion yen. Shipments from Fuji Heavy Industries Ltd.(FHI) to its Canadian subsidiary generated an exchange gain of 1.9 billion yen due to an approximate eleven-yen depreciation against the Canadian dollar. There was an exchange gain of an additional 0.5 billion yen arising from SIA’s sales to our Canadian subsidiary due to the strong Canadian dollar against the US dollar, making the total exchange gains from the Canadian dollar 2.4 billion yen. There were also gains of approximately 1.1 billion yen resulting from the approximate ten-yen depreciation against the Euro.

We gained 6.0 billion yen from material cost reductions, 3.4 billion yen at FHI and 2.6 billion yen at SIA. This included a 13.0 billion yen increase in material costs due to a hike in steel prices as well as buoyant market conditions.

An additional gain of 1.4 billion yen was generated from the reduction of overhead costs. These can be broken down into four factors: [1] Reduction of fixed manufacturing costs led to a gain of 7.4 billion yen (7.9 billion yen for FHI, 0.3 billion yen for SIA, -0.8 billion for consolidated adjustment, etc.). This included a decrease in the cost of dies (2.9 billion yen) and fixed processing costs (5.0 billion yen) at FHI, while an increase in the cost of dies (-0.7 billion yen) at SIA was offset by decreases in depreciation expenses and labor costs. [2] An increase in SG&A expenses led to a loss of 5.0 billion yen. Domestically, SG&A cost reduction led to 4.0 billion profit by both FHI and dealers, but internationally, the cost increase led to a loss of 9.0 billion mainly by SOA due to a $500 per vehicle increase in incentives from $1,500 to $2,000 (-$55 million) from the previous year and a rise in advertising costs (-$14 million). [3] A loss of accrued warranty costs led to a loss of 1.2 billion yen and [4] the other reasons led to a gain of another 0.2 billion yen.

Factors leading to a profit decrease included an increase in R&D expenses (from 33.2 billion yen to 37.4 billion yen) that led to a drop of 4.2 billion yen in profit. This increase in R&D costs is due to the full model change, which is planned to introduced in each year for at least one model among the Impreza, Forester, Legacy and others.

We lost 16.1 billion yen due to the deterioration of sales volume and mix. This can be broken down into three factors: [1] Domestically, we suffered a loss of 9.1 billion yen with the reduction in the sales volume of passenger cars. [2] Internationally, despite increasing sales volume, a loss of 14.6 billion yen was recorded due to deteriorated product mix. [3] Unrealized inventory adjustments and other reasons caused an increase of 7.6 billion yen.

Overall, we experienced a decrease in operating income of 1.8 billion yen.

|