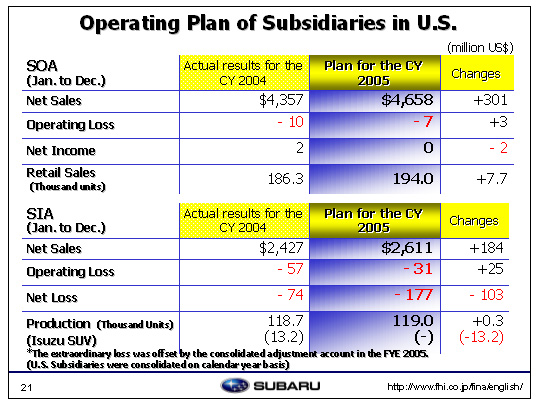

| SOA is expected see an increase of $301 million in net sales both in terms of volume thanks to the positive impact of the new Legacy and the B9 Tribeca. Operating loss is expected to go down by $3 million to negative $7 million owing to the increased sales volume of the B9 Tribeca and a improved product mix despite estimated increases of sales incentives totaling $19.2 million (up from $1,300 in 2004 to $1,400 in 2005) and advertising cost increases. Estimated income and profits are set lower than projected at the end of the first half of this fiscal year due to the declining sales volume and increase of incentives.

SIA will see an increase of $184 million thanks to favorable sales of the B9 Tribeca. Operating losses will decrease by $25 million to negative $31 million on a year-on-year basis. Factors for this include positive changes in the product mix brought by the launch of the B9 Tribeca, successful cost reduction measures and a reduction of fixed costs. All these positive aspects will offset the fixed costs associated with the launch of a new model (supplier’s dies), labor cost and increases in expenses. The net loss for this fiscal year is $177 million, down $103 million, due to extraordinary losses generated from the cancellation of leased facilities as a result of terminating consignment production for Isuzu in March of 2005 as well as impairment losses. This extraordinary loss of US$196 million has been written off in the consolidated adjustment account for the fiscal year ended March 2005. |