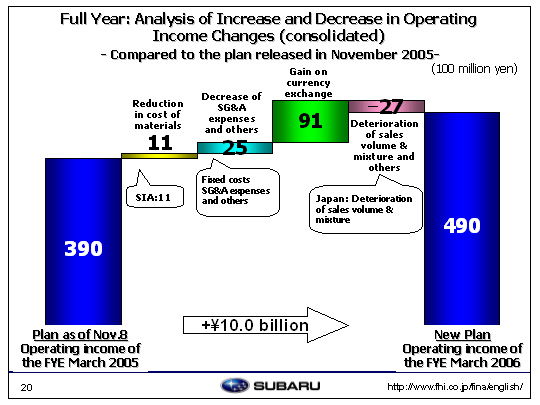

| Here are some details explaining the upward revision of the estimated operating income from the 39 billion projected at the end of the first half to 49 billion yen. Factors leading to profit increase: Cost of raw materials is expected to go down by 1.1 billion yen thanks to SIA’s steady cost reduction efforts. The estimated amount of R&D costs remains unchanged at 49 billion yen as projected at the end of the first half of the fiscal year. We expect to see a decrease of 2.5 billion yen in overhead. A breakdown of this shows fixed manufacturing costs down by 2 billion yen, reduced labor costs through companywide cost cutting efforts as well as a 0.3 billion yen reduction in SG&A expenses. SG&A expenses will increase at FHI and at SOA but will be offset by a decrease at domestic dealers. The major factor for this is the foreign exchange rate fluctuations, which will generate estimated exchange gains of 9.1 billion yen. The estimated exchange rate for the yen will go up about 3 yen against the US dollar (from 108 to 111), about 3 yen against the euro (from 133 to 136) and about 3 yen against the Canadian dollar (from 90 to 93), resulting in exchange gains of 7.7 billion yen from the US dollar, 0.5 billion yen from the euro, and 0.9 billion yen from the Canadian dollar. Factors leading to decreased profits include a loss of 2.7 billion yen due to deterioration of product sales and mixture, losses of 2.5 billion yen in the domestic market and 0.7 billion yen in overseas markets, in addition to 1 billion yen in inventory adjustment. Overall, estimated operating income has been revised upward by 10 billion yen. |