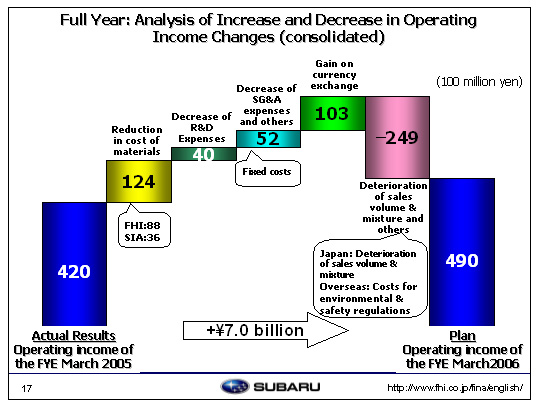

| Causes for the increase in operating income from 42 billion yen to 49 billion yen are as follows: Reasons behind areas of increased profits include a reduction in materials cost of 12.4 billion yen, of which 8.8 billion yen was seen at FHI and 3.6 billion yen at SIA. SIA cut costs by 1.1 billion yen more than estimated in the November forecast. R&D costs will be reduced by 4 billion yen from 53 billion to 49 billion, remaining unchanged from the midterm forecast. Overhead is expected to decrease by 5.2 billion yen. A breakdown of this shows fixed manufacturing costs down by 7.7 billion yen. Depreciation of the dies for the Legacy should fall in Japan while depreciation of the dies associated with the Legacy and the B9 Tribeca at SIA should increase, bringing the total overhead down. SG&A expenses are expected to increase by 0.5 billion yen over the previous year. Incentives at SOA are forecast to increase by US$100 (US$1,300 to US$1,400), while advertising costs are also predicted to rise year-on-year due to the introduction of the B9 Tribeca. Advertising expenses associated with FHI and domestic dealerships as well as sales incentives are expected to decrease. Also with regard to decreases we saw last year in expenses associated with warranties, a reversal in the recall provision amounting to 4 billion yen will not be seen this period but we will set aside normal warranty provisions. An estimated foreign exchange gain of 10.3 billion is expected to be derived from exchange rate fluctuations with the yen moving up against the US dollar by about 3 yen (from 108.27 to 111.49), the yen against the euro up about 1 yen (from 134.88 to 136.34) and the yen against the Canadian dollar up about 9 yen (from 83.50 to 93.24). These should result in exchange gains of 7.4 billion yen from the US dollar, 0.2 billion yen from the euro, and 1.7 billion yen from the Canadian dollar. Additionally, exchange gains of another 1 billion yen are expected from SIA’s sales to our Canadian subsidiary due to the strong Canadian dollar against the US dollar, making the total exchange gains from the Canadian dollar 2.7 billion yen. We expect a 24.9 billion yen loss as a result of deterioration sales volume and product mixture. We expect to see a loss of approximately 18 billion yen in domestic sales and a loss of 2 billion yen in overseas sales that includes approximately 11 billion yen loss in FHI sales due to costs associated with improving specification to meet safety and environmental regulations which could not be reflected in the sales price. Inventory adjustments will result in a 5 billion yen drop. Overall operating income is projected to increase 7 billion. |