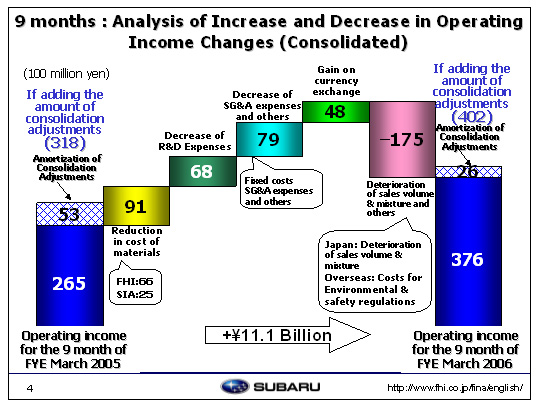

Here is a more detailed analysis of the increase in operating income from 26.5 billion yen to 37.6 billion yen.

Factors leading to profit increase:

Reduction in cost of materials was 9.1 billion yen, of which Fuji Heavy Industries Ltd.(FHI) accounted for 6.6 billion yen and SIA 2.5 billion yen, thanks especially to SIA’s cost reduction efforts despite increasing cost of steel, plastic and precious metal etc. as well as the fact that FHI successfully reached its cost reduction targets ahead of schedule.

R&D expenses decreased 6.8 billion yen from 40 billion yen to 32.2 billion yen. This was largely due to streamlined R&D operations for our new passenger mini car model to be launched next year, and Impreza FMC, as well as the completion of R&D activities for the B9 Tribeca and the cancellation of new platform development.

Overhead costs decreased by 7.9 billion yen, along with a 5.9 billion yen drop in fixed manufacturing costs. This reduction came after FHI terminated its depreciation of dies for the Legacy model. However, fixed costs rose due to the release of new models at SIA and increase in the depreciation of dies for the Legacy and B9 Tribeca. SG&A expenses were cut by 1.6 billion yen mainly because advertising expense and sales incentives at FHI and dealers. Incentive costs at SOA, on the other hand, have increased. There has also been an increase of 1 billion yen provision for warranties (loss from reversal in allowance for recalls), with the remainder being found in other areas.

Currency exchange gains totaled 4.8 billion yen. There was an approximately one-yen rise in the yen against the US dollar (from 109.38 to 110.54), resulting in exchange gains amounting to 2.4 billion yen. There was also an approximately nine-yen rise in the yen against the Canadian dollar (from 83.22 to 91.98), resulting in exchange gains of 1.2 billion yen, along with exchange gains of another 1 billion yen arising from SIA’s sales to our Canadian subsidiary due to the strong Canadian dollar against the US dollar, making the total exchange gains from the Canadian dollar 2.2 billion yen. There were also gains of 0.2 billion yen resulting from the approximately two yen rise in the yen against the euro (from 134.07 to 136.15).

Factors leading to profit decrease:

We suffered a loss of 17.5 billion yen due to a deterioration in sales volume and product mix. This amount included a loss of 11 billion yen in domestic sales due largely to a decline in the sales volume of the Legacy and the R2 as well as the unfavorable product mix for the Legacy. Overseas sales dropped by 3 billion yen. This includes a 7 billion yen loss in FHI sales due to costs associated with improving specifications to meet safety and environmental requirements which could not be reflected in the sales price. Inventory adjustments as well as other factors resulted in a decrease of 3.5 billion yen. This all led to an increase of 11.1 billion yen in operating income.

|