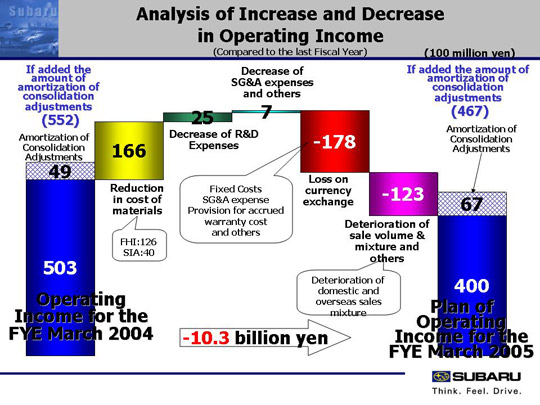

| Here are some more details concerning the decrease of 10.3 billion yen in operating income year on year. Factors leading to profit increase: We will aim for a cost reduction of 16.6 billion yen, 12.6 billion yen by Fuji Heavy Industry Ltd. and 4 billion yen by SIA. We will try to achieve this target despite the significant increase in material cost. We will reduce R&D expenses by 2.5 billion (from 57.5 to 55 billion) through more efficiency and improvements by utilizing digital development and other technical rationalization. We will cut 0.7 billion yen in total from other expenses. Although we expect to see an increase of 6 billion yen in fixed costs and 2 billion yen in sales and general administrative expenses, this increase will be offset by a decrease of approximately11.1 billion yen in warranty costs (8.5 billion yen in allowances and 2.6 billion yen in product warranty). Factors leading to profit decrease: An estimated foreign exchange loss of 17.8 billion is expected, most of which derived from the Yen/ US dollar exchange transaction. We expect a 12.3 billion yen loss due to our sales product mixture. We expect to see a loss of approximately 10 billion yen in domestic sales. Overseas sales will break even. The deterioration of sales product mixture is forecasted to continue in both domestic and overseas markets.We expect to see a loss of approximately 3 billion yen due to inventory adjustment with an increase of 2 billion yen in components sales and others. |