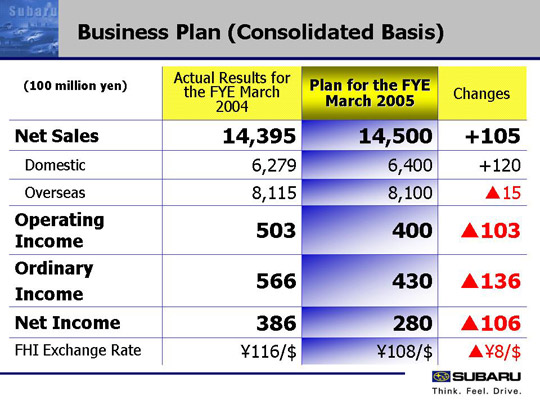

| Estimated net sales for this fiscal year will remain at 1.45 trillion yen as projected at the end of the first half period. That will be an increase of 10.5 billion yen over the previous fiscal year. Operating income is expected to decrease by 10.3 billion yen over the previous fiscal year to 40 billion yen due to continued deterioration of the product mixture both in domestic and overseas markets despite our continued efforts in reduction of materiall cost and headcount to make up for the foreign exchange loss caused by the appreciation of the yen. Further details on operating income will be provided later. Despite an increase of 1.8 billion yen in the amortization of consolidation adjustments caused by SIA related transaction (from 4.9 billion yen to 6.7 billion yen), ordinary income is expected to be 4.3 billion yen, 13.6 billion less than the previous fiscal year’s level due to foreign exchange loss and others. In addition to some factors which led to falling profits such as a decline in the gain on sale of investment securities that we enjoyed last year, we are faced with a balance difference between extraordinary loss and the amortization of consolidation adjustment account as a result of the termination of consignment production of Isuzu vehicles in the third quarter. Combined with deferred tax, we expect to see income drop by 10.6 billion yen to 28 billion yen. |