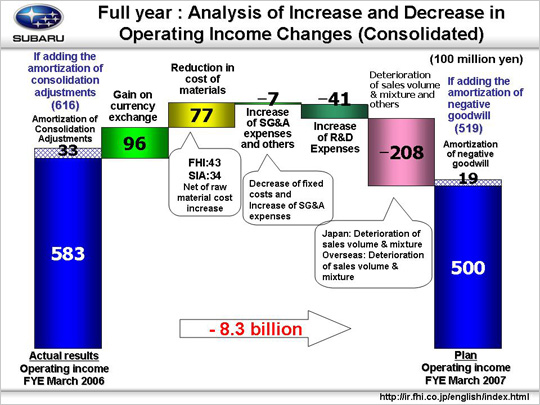

| Here, we analyze the reasons for the decline in operating income from 58.3 billion yen to 50 billion yen. First, in terms of increase factors, the gains on currency exchange came to 9.6 billion yen. By regional currency, the U.S. Dollar accounted for 6.6 billion yen of this gain with a 3 yen weakening in the yen. The Euro generated 0.8 billion yen in exchange gains with a weakening of some 3 yen. For the Canadian Dollar, the share was 2.2 billion yen – the total of 1.4 billion yen from a depreciation of some 6 yen on shipments from Fuji Heavy Industries to Canada, and 0.8 billion yen on shipments to SIA from the Canadian subsidiary due to a strong Canadian Dollar and weak U.S. Dollar. Reductions in cost of materials costs totaled 7.7 billion yen, with FHI accounting for 4.3 billion yen of that figure and SIA the remaining 3.4 billion yen. A price hike in raw materials of 17 billion yen is forecast, with the worsened market conditions expected to have a particularly large impact. Next as operating income decrease factors, we can identify the 0.7 billion yen increase in overhead and other expenses. This spending can be broken down into four categories. First, the income increase from the reduction in fixed manufacturing costs of 8.7 billion yen. Second, the 3.7 billion yen decline in income from increased sales and general administrative expenses. In Japan, there was an income increase of about 4.0 billion yen, with both FHI and the dealers cutting the expenses in this category. Overseas, in contrast, there was an income decline of about 8.0 billion yen, stemming largely from the move by SOA to increase incentives by about $350 per unit compared to last year. Third, a reduction in the reversal of allowance for recalls and increase of warranty costs generated losses of 2.1 billion yen. And fourth, the loss of another 3.6 billion yen in income for other reasons. The rise in R&D expenses (from 46.9 billion to 51.0 billion yen) will lead to another 4.1 billion yen drop in profit. New model development will be advanced from here on as well. The deterioration of sales volume and mixture, meanwhile, will lead to 20.8 billion yen in losses. This includes a worsening of 1.0 billion yen in costs for improving safety and environmental specifications impossible to reflect in sticker prices. This can be grouped into three categories. First, domestically, the impact of the decrease in unit sales was a factor in the 10.1 billion yen income drop. Second, an overseas decline of 21.9 billion yen, with deterioration in both sales volume and mixture. And third, 11.2 billion yen from inventory adjustments and other sources. As a result of this, the plan for operating income is a projected decline of 8.3 billion yen. |