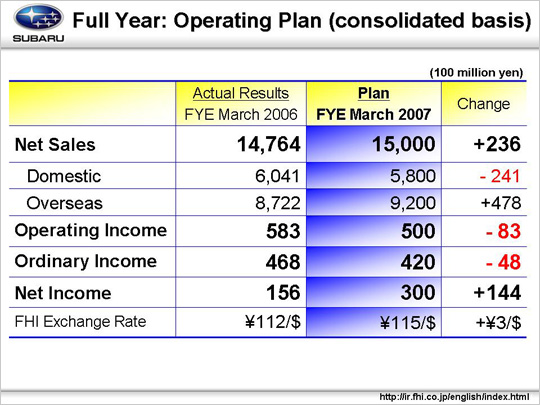

| For the full year operating plan, net sales are projected to increase 23.6 billion yen to 1.5 trillion yen. However, in view of the harsh sales conditions in the U.S. and Japan, this represents a downward revision of 50 billion yen from the 1.55 trillion yen plan announced at the beginning of the year. For operating income, although there has been no change in the 50 billion yen projection at the beginning the year, further details will be explained next part. The non-consolidated sales rate was revised at 115 yen to the U.S. dollar, weaken 5 yen from initial plan. In real terms, the change in FOREX condition and cost reduction offset the tough sales conditions. Ordinary income, the foreign exchange hedge rate for this year is roughly 111 yen to the U.S. dollar, with foreign exchange losses thus predicted to occur. The projection is for ordinary income of 42 billion yen, a downward revision of 8 billion yen from the projections at year’s start. Net income is forecast at 30 billion yen, representing no change from the initial project at year’s start. |