|

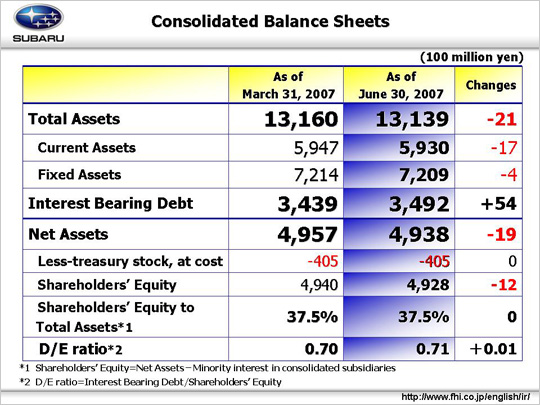

The balance sheets showed total assets decreasing by 2.1 billion yen to 1,313.9 billion yen from the end of the previous fiscal year. The primary reason for this was the stronger yen rate as of the end of March, which was used in converting sales of overseas subsidiaries from US$ to yen, compared with the rate as of the end of December of last year.

Current assets dipped 1.7 billion yen despite some ups and downs in Cash and time deposits, Notes and accounts receivable, trade and Short-term loans.

Under fixed assets, Construction in progress was transferred to Machinery, equipment and vehicles due to the production launch of Toyota Camry at SIA. This plus the revaluation of investment securities under investments and other assets brought fixed assets up 4.2 billion yen.

Interest-bearing debt remained flat despite a 6.0 billion yen commercial paper issued by our subsidiary, Subaru Finance Co., Ltd., and the shifting of long-term loans to short-term loans at an overseas subsidiary. The debt-to-equity ratio also remained flat at 0.71.

In the net assets section, Cash dividend of 3.2 billion yen was paid and accumulated Retained earnings decreased. Net assets totaled 493.8 billion yen.

Shareholders’ equity to Total assets, for which ratio has been calculated by excluding Minority interest in consolidated subsidiaries from Total net assets since the previous fiscal year, remained unchanged at 37.5%.

The debt-to-equity ratio edged up slightly.

|