|

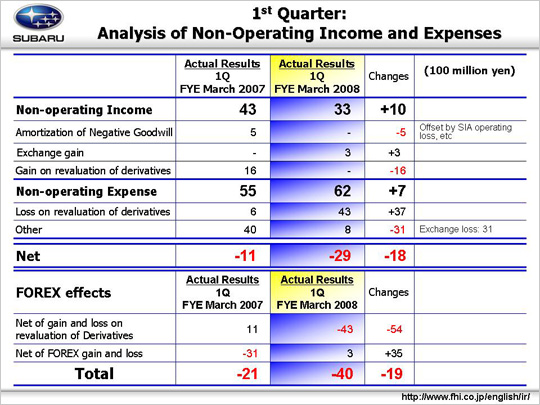

Non-operating income and expenses was down 1.8 billion yen from the same period of last fiscal year.

Major factors for this decrease include the following.

Although there was 0.5 billion yen in amortized negative goodwill during the first quarter of last fiscal year, which offset the increase in SIA’s shared fixed costs after terminating the JV with Isuzu, no figure was posted this fiscal year since the amortization of negative goodwill was completed during the previous fiscal year.

Foreign exchange fluctuations had the most significant impact on non-operating income and expenses, affecting (1) gain and loss on revaluation of derivatives, and (2) foreign exchange gain and loss.

(1) Net gain and loss on revaluation of derivatives dipped 5.4 billion yen on a year-on-year basis, with a 1.6 billion yen decrease in the gain on the revaluation of derivatives for non-operating income and a 3.7 billion yen increase in the loss on the revaluation of derivatives for non-operating expenses.

(2) Net of foreign exchange gain and loss increased by 3.5 billion yen on a year-on-year basis due to the difference of the market rate and hedge rate (¥119/US$ VS ¥118/US$).

Overall foreign exchange effects led to an increase of 1.9 billion yen in foreign exchange losses compared with the first quarter of previous fiscal year.

The total foreign exchange loss of 4.0 billion yen incurred during the first quarter accounts for a major portion of the 2.9 billion yen deference between 3.5 billion yen in operating income and 0.6 billion yen in ordinary income.

|