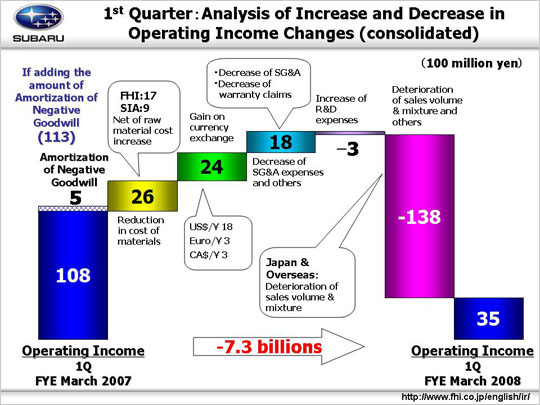

Moving on to the reasons for the change in operating income from 10.8 billion yen to 3.5 billion yen.

We gained 2.6 billion yen due to the reduction in cost of materials, with 1.7 billion yen at Fuji Heavy Industries Ltd. (FHI) and 0.9 billion yen at SIA. This includes an increase of 2.1 billion yen in material costs due to deteriorated market conditions incurred by FHI and SIA, amounting respectively to 1.4 billion yen and 0.7 billion yen.

An increase of 2.4 billion yen was due to foreign exchange gains. There was an approximate four-yen depreciation against the U.S. dollar, resulting in an exchange gain of 1.8 billion yen. A 0.3 billion yen exchange gain was garnered as a result of an approximate seventeen-yen depreciation against the Euro. Shipments from FHI to its Canadian subsidiary generated an exchange gain of 0.3 billion yen due to an approximate six-yen depreciation against the Canadian dollar. There was no exchange gain from SIA’s shipments to our Canadian subsidiary from the conversion of the Canadian dollar against the U.S. dollar.

An additional gain of 1.8 billion yen was generated from the decrease of SG&A expenses and others. The amount can be broken down into four areas. A) Fixed manufacturing costs remained flat (-0.6 billion for FHI, 0.8 billion for SIA, consolidated adjustment -0.2 billion yen). This included an increase of 0.3 billion yen in expenses for suppliers’ dies and an increase of 0.3 billion yen in the depreciation cost at FHI, which was offset by a decrease in the depreciation costs at SIA. B) SG&A expenses decreased by 0.9 billion yen. Although advertising costs increased at FHI (-0.2 billion yen) was covered by domestic dealers’ efforts to cut SG&A expenses (0.6 billion yen) and 0.7 billion yen ($6M) decrease in total incentives cost (from $2,000 per unit to $2,300 per unit) at SOA due to a drop in the sales volume {SOA total decrease of SG&A cost was 0.4 billion yen as the incentive cost decrease was offset by increases in advertising costs (-0.1 billion yen) and SG&A expenses (-0.2 billion yen)}. C) We saw a gain of 1.0 billion yen from a reversal in allowance for service campaigns. D) A loss of another 0.1 billion yen for other reasons.

Factors leading to the profit decrease included an increase in R&D expenses that led to a 0.3 billion yen decline in profit (from 11.1 billion yen to 11.4 billion yen). This increase in R&D expenses was related to the development of the new Forester.

We lost 13.8 billion yen due to a deterioration of sales volume and mixture and others. A) Domestically we suffered a loss of 3.3 billion yen. Factors included the decline in the sales volume for models other than the Impreza and the Stella as well as a deterioration in the sales mix for Legacy and passenger minicars. B) Internationally we suffered a loss of 9.9 billion yen. The deterioration of the sales mix was due to the poor performance of the Legacy and the Impreza in addition to the adjustment due to the change in the retail prices at our U.S. subsidiaries. Inventory adjustments, etcetera caused a decrease of 0.6 billion yen.

All this brought operating income down 7.3 billion yen.

|