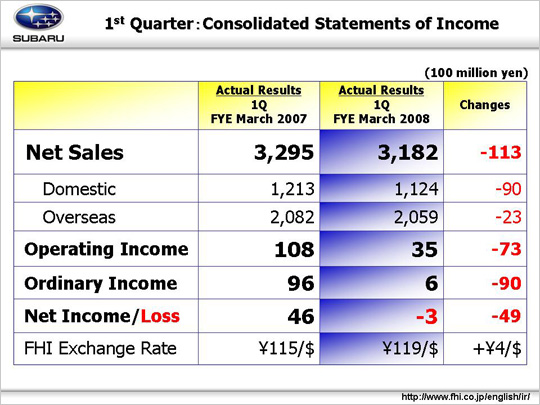

Net sales for the 1st quarter of the fiscal year ending March 2008 decreased by 11.3 billion yen as a result of the decrease in the domestic and overseas sales volume and deteriorated sales mix despite the positive effect of a weak yen against the U.S. dollar.

Operating income dropped by 7.3 billion yen to 3.5 billion yen due to the deterioration of the both domestic and overseas sales volume and mix and a slight increase of R&D expenses. This loss could not be covered by foreign exchange gains, accelerated reduction in cost of materials and decrease of SG&A expense. More details will be explained later.

Ordinary income dropped 9.0 billion yen to 0.6 billion yen on a year-on-year basis. Major factors for this decline include the loss on revaluation of derivatives and the amortization of negative goodwill for Subaru of Indiana Automotive Inc.(SIA).

Net income fell from 4.9 billion yen to 0.3 billion yen net loss despite an extraordinary gain of approximately 1.4 billon yen as a result of the tender of shares in response to take-over bit for the shares of Fuji Robin Industries Ltd by Makita Corporation. This was mainly because domestic dealership could not apply deferred tax accounting.

|