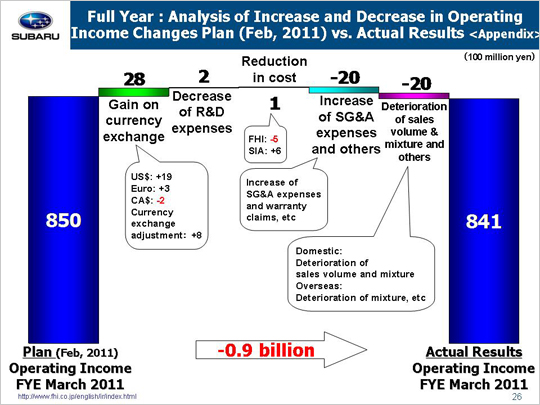

Now let’s look at why the actual operating income of 84.1 billion yen fell short of our projection of 85.0 billion announced at the end of the third quarter.

Gain on currency exchange led to an increase of 2.8 billion yen. While the exchange rate for the US dollar was almost same as we had projected, we gained 1.9 billion yen due to a fractional point. We also gained 0.3 billion yen from a fractional point between the actual and estimated exchange rates for the euro. While the exchange rate for the Canadian dollar was about the same as our projection, we lost 0.2 billion yen due to broken number. We also experienced a gain of 0.8 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries.

There was a gain of 0.2 billion yen on reduced R&D expenses.

A gain of 0.1 billion yen due to a reduction in material cost in addition to a loss of 0.5 billion yen at FHI and a gain of 0.6 billion yen at SIA. FHI experienced a loss of 1.2 billion yen due to the impact of the earthquake and a gain of 0.7 billion yen due to material price decrease. SIA posted a loss of 2.2 billion yen due to a reduction in material cost and a gain of 2.8 billion yen related to material price decrease.

Factors that led to decreased operating income include a loss of 2.0 billion yen due to an increase in SG&A and other expenses. This loss can be broken down into the following three areas. First, we see that a reduction in fixed manufacturing costs generated a gain of 1.6 billion yen, with a gain of 1.4 billion yen coming from FHI and another gain of 0.2 billion yen at SIA. FHI generated a gain of 1.6 billion yen due to reduced fixed processing costs and a loss of 0.2 billion yen due to an increase in depreciation of suppliers' dies. SIA gained 0.2 billion yen due to lower fixed processing costs. The second area encompasses an increase in SG&A expenses that led to a loss of 0.3 billion yen, with a gain of 1.5 billion yen at FHI and a loss of 0.1 billion yen at domestic dealers. SOA generated a gain of 1.3 billion yen. This figure includes a gain of 0.1 billion yen due to reduced advertising expenses, a gain of 0.1 billion yen owing to lower SG&A expenses, and a loss of 1.0 billion yen due to the fact that the actual 1,200 dollar per-unit incentive was 200 dollars less than the 1,400 dollar incentive initially projected. Our Canadian subsidiary generated a gain of 0.2 billion yen while our other subsidiaries saw a combined loss of 3.2 billion yen. Finally, the third factor includes an increase in costs associated with warranty claims that led to a loss of 3.3 billion yen.

We suffered a loss of 2.0 billion yen due to a deterioration in the sales volume and mix, etc.. This loss can be broken down into the following three areas. First, we have a loss of 2.1 billion yen due to the domestic sales volume falling short of the projected sales volume by 2,550 units, which can be attributed to the impact of the earthquake. Next, we lost 7.9 billion yen due to a deteriorated sales volume and mix in overseas markets where the actual sales volume was 3,844 units less than the projection due to the effect of the earthquake. The third factor is a gain of 8.0 billion yen due to inventory adjustments, etc.

These factors combined brought operating income down 0.9 billion yen. |