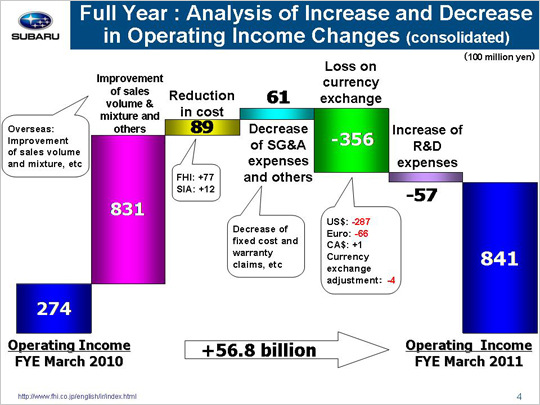

| Now let’s look at the reasons for the year-on-year increase in operating income that took from 27.4 billion yen to 84.1 billion yen. One of the main factors leading to the increase in operating income included a gain of 83.1 billion yen due to an improvement of sales volume and mixture. This gain can be broken down into the following three areas. The first is a loss of 12.2 billion yen in the domestic market due to declining sales triggered by the discontinuation of the eco-car tax subsidy programs as well as the impact of the earthquake. Next, we see an overseas market gain of 79.9 billion yen thanks to across-the-board sales volume increases, most notably being outstanding sales of the Legacy. Finally, we had a gain of 15.4 billion yen due to inventory adjustments and others. Reduction in cost generated a gain of 8.9 billion yen, including a gain of 7.7 billion yen at FHI and a gain of 1.2 billion yen (12 million dollars) at SIA. FHI generated a gain of 20.4 billion yen due to a reduction in cost with loss amounting to 12.7 billion yen due to increased material prices. SIA posted a gain of 5.4 billion yen (58 million dollars) due to a reduction in cost and a loss of 4.2 billion yen (46 million dollars) related to rising material prices. We also saw a decrease in SG&A expenses, etc.. that led to a gain of 6.1 billion yen. This amount can be broken down into the following three areas. First, we see that a reduction in fixed manufacturing costs generated a gain of 9.5 billion yen, with a gain of 9.9 billion yen at FHI and a loss of 0.4 billion yen (4 million dollars) at SIA. FHI yielded a gain of 6.9 billion yen due to decrease of depreciation of suppliers’ dies and a gain of 4.0 billion yen due to lower fixed processing cost. SIA gained 1.2 billion yen (13 million dollars) due to decrease of the depreciation of suppliers’ dies and loss of 1.6 billion yen (17 million dollars) due to increased processing cost. Next, we saw an increase in SG&A expenses which yielded a loss of 5.0 billion yen. FHI generated a loss of 3.7 billion yen due to increased transportation and packing costs in tandem with an increasing sales volume. Domestic dealers also generated a gain of 3.8 billion yen due to ongoing efforts to lower SG&A expenses. SOA, on the other hand, saw a loss of 0.4 billion yen (4 million dollars), which included a gain of 2.7 billion yen (29 million dollars) due to reduced advertising expenses and a loss of 3.1 billion yen (33 million dollars) due to increased incentive cost. Although the per-unit incentive was cut by 100 dollars, down from 1,100 dollars for FY2010 to 1,000 dollars for FY2011, the total incentive cost was up due to the increased sales volume. Our Canadian subsidiary also experienced a loss of 1.0 billion yen due to an increased sales volume resulted in pushing up the incentive cost amounts while our other subsidiaries saw combined losses of 3.7 billion yen. Finally, the third factor includes a decrease in warranty claims costs that led to a gain of 1.6 billion yen. Major factors behind the profit downturn included exchange rate fluctuations generating a loss of 35.6 billion yen. This included a loss of 28.7 billion yen due to an approximate 7 yen appreciation against the U.S. dollar, a loss of 6.6 billion yen due to an approximate 18 yen appreciation against the euro, and a gain of 0.1 billion yen coming from the exchange rate for the Canadian dollar which remained flat. This figure also included a loss of 0.4 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries. We saw a loss of 5.7 billion yen due to increased R&D expenses related to developing new models and more environmental friendly features. These factors combined brought operating income up 56.8 billion yen. |