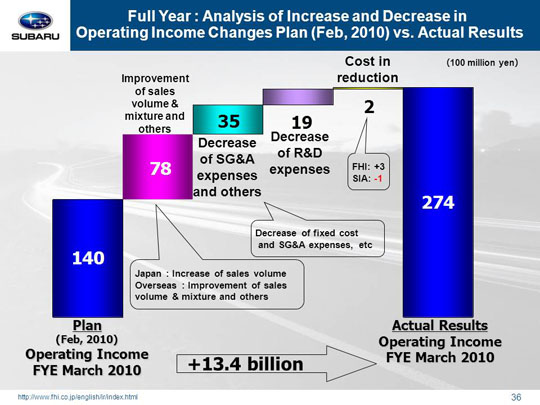

Now let’s look at why the actual FY 2010 operating income of 27.4 billion yen was 13.4 billion yen higher than the previous projection of 14.0 billion announced at the end of the third quarter.

The major factor behind the increase in the operating income figure was a 7.8 billion yen increase due to an improved sales volume and mixture. This factor can be broken down into three areas: (1) a domestic market gain of 2.2 billion yen due to higher sales volume of passenger car; (2) an overseas market gain of 5.4 billion yen with increased sales in North America and Europe due to a better sales volume and mixture; and (3) a gain of 0.2 billion yen due to inventory adjustments and others.

Decreased SG&A expenses and others generated a gain of 3.5 billion yen. (1) This figure includes a reduction in fixed manufacturing costs that generated a gain of 1.0 billion yen in total, with a gain of 0.6 billion yen at FHI and a gain of 0.4 billion yen at SIA. (2) Lower SG&A expenses provided a gain of 3.6 billion yen in total. FHI generated a gain of 1.0 billion yen and domestic dealers generated a loss of 1.6 billion yen. SOA generated a gain of 0.5 billion. Our Canadian subsidiary generated a loss of 0.1 billion yen while other subsidiaries produced an overall gain of 3.8 billion. (3) The increase in costs associated with warranty claims resulted in a loss of 0.6 billion yen (4) Increases in other expenses generated a loss of 0.5 billion yen.

Reduction in R&D expenses (from 39.0 billion yen to 37.2 billion yen) resulted in a loss of 1.9 billion yen.

Cost reduction initiatives generated an overall gain of 0.2 billion yen, with a gain of 0.3 billion yen at FHI and a loss of 0.1 billion yen at SIA.

The foreign exchange rate had no real impact on operating income. The yen remained relatively stable against the US dollar with foreign exchange losses totaling 0.2 billion. We incurred a 0.3 billion yen loss due to an approximately one yen appreciation against the euro and a gain of 0.2 billion yen due to an approximate one yen depreciation against the Canadian dollar. This figure also includes a gain of 0.3 billion yen due to foreign exchange adjustments for transaction between FHI and its overseas subsidiaries.

These factors combined brought operating income up 13.4 billion yen to total 27.4 billion yen.

|