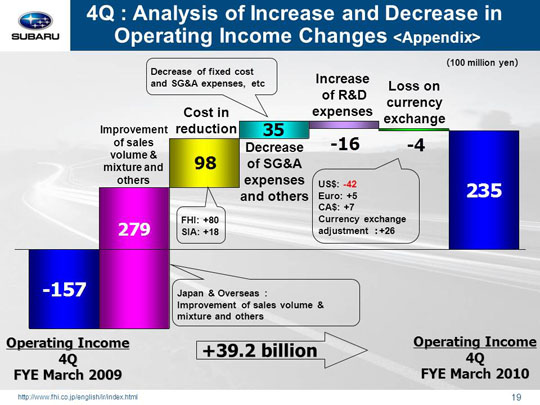

Let’s look at the factors behind the year-on-year increase in operating income from -15.7 billion yen to 23.5 billion yen.

An improvement in the sales volume and mixture added 27.9 billion yen to our bottom line, including: (1) a domestic market gain of 6.9 billion yen thanks to increased sales of passenger cars including a boost to the sales volume and mixture from the new Legacy; (2) an overseas market gain of 24.8 billion yen due to increased sales in North America, Europe, Australia, and China as well as an improvement in the sales mixture resulting from the launch of the new Legacy; and (3) a loss of 3.8 billion yen from inventory adjustments, etc.

We gained 9.8 billion yen due to a reduction in materials cost, saving 8.0 billion yen at FHI and 1.8 billion yen at SIA. FHI gained 2.6 billion yen after cutting material costs, and 5.4 billion yen after recouping losses from last year’s hiked up prices for precious metals, etc. SIA posted gains of 2.6 billion yen from the reduction of material costs and losses of 0.8 billion yen related to rising material prices.

We also gained 3.5 billion yen on lower SG&A expenses, etc. This gain included a drop in fixed manufacturing costs that added 2.5 billion yen to FHI’s bottom line with losses of 0.1 billion yen at SIA bringing overall gains down to 2.4 billion yen. FHI saw a gain of 1.9 billion yen due to a reduction in fixed processing costs and another gain of 0.6 billion yen due to a decrease in expenses for suppliers’ dies. SIA experienced a loss of 0.1 billion yen, which included a gain of 0.7 billion yen due to reduced expenses for suppliers’ dies and a loss of 0.8 billion yen from increased processing costs. Decreased SG&A expenses resulted in a gain of 1.6 billion yen. Both FHI and domestic dealers generated losses 1.1 billion yen and 0.5 billion yen respectively due to the year-end sales promotion. SOA generated a loss of 0.3 billion yen due to a 1.2 billion yen increase in advertising expenses and a 0.4 billion yen increase in SG&A expenses and others. These losses were offset by a 700 dollar drop in the per-unit incentive that brought the 1,900 dollar incentive between October and December 2008 down to 1,200 dollars for January to March 2010. The smaller incentives resulted in a gain of 1.4 billion yen. Our Canadian subsidiary generated a gain of 0.2 billion yen, while other subsidiaries realized a gain of 3.3 billion yen due to cost reduction efforts. Finally, on the downside an increase in costs associated with warranty claims generated a loss of 0.5 billion yen.

Losses come primarily from increased R&D costs of 1.6 billion yen (up from 8.8 billion yen to 10.4 billion yen) for the development of the new models and engines.

Exchange rate fluctuations generated a loss of 0.4 billion yen. This included a loss of 4.2 billion yen due to an approximate one yen appreciation again the US dollar, a gain of 0.5 billion yen due to an approximate eight yen depreciation against the euro, a gain of 0.7 billion yen due to an approximate 12 yen depreciation of the Canadian dollar, and a gain of 2.6 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries.

These factors combined brought operating income up 39.2 billion yen to total 23.5 billion yen.

|