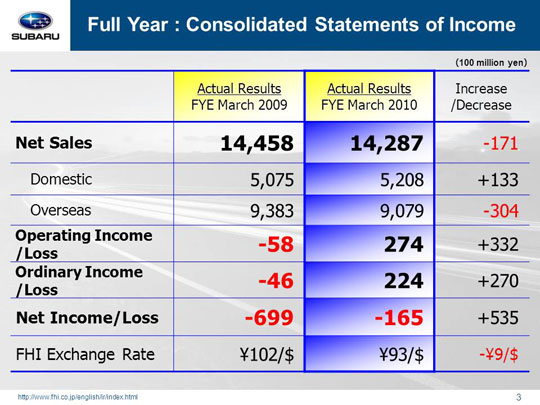

Net sales for the fiscal year ended March 2010 dipped 17.1 billion yen year on year to total out at 1,428.7 billion yen. Major factors behind the decrease included an exchange loss of 83.9 billion yen due to the appreciation of the yen against US dollar, euro, and Canadian dollar. The decline occurred despite an increase of 57.6 billion yen from an improved sales volume and mixture and increase in sales at three internal companies and others totaling 9.2 billion yen. Operating income was up 33.2 billion yen year on year for a total of 27.4 billion yen. This increase was mainly due to the improvement of sales volume and mixture, reduction in materials cost as well as expenses related to SG&A, R&D, etc. The gains offset loss on currency exchange due to the appreciation of the yen. The actual results topped our previous projection of 14.0 billion yen, announced at the release of third quarter results, by 13.4 billion yen. Further details will be provided later on. Ordinary income also rose 27.0 billion yen year on year to bring ordinary income to a total of 22.4 billion, 12.4 billion yen above the previous projection of 10.0 billion yen announced at the release of third quarter results. While loss before income taxes and minority interests totaled 0.4 billion yen, losses were improved 21.1 billion yen compared to the previous fiscal year. Major factors behind the loss included an impairment loss on property of 10.5 billion yen as well as a loss on abandonment of inventories of 1.2 billion yen at the Industrial Production Division on top of a domestic dealerships impairment loss of 5.2 billion yen. Our net loss totaling 16.5 billion yen, after paying taxes for our flourishing US subsidiaries, up 53.5 billion yen on a year-on-year basis as there was a reversal of deferred tax assets amounting to 39.4 billion yen at Fuji Heavy Industries Ltd. (FHI) in the previous fiscal year. Net loss figure was 8.6 billion yen higher than the previous projection of 25.0 billion yen announced at the end of the third quarter. |