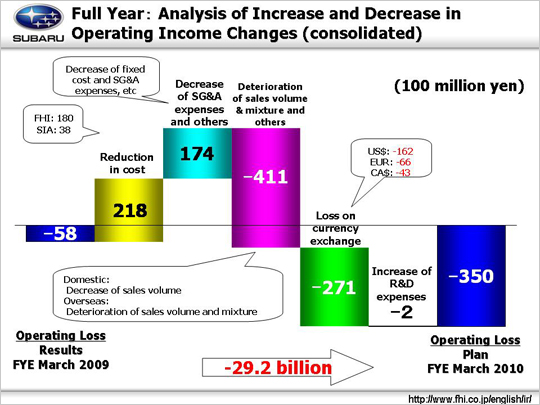

| Now let’s look at the factors behind the projected increase in operating loss from 5.8 billion yen to 35.0 billion yen. The factors that will lead to an increase in operating income include a reduction in cost of 21.8 billion yen, of which 18.0 billion yen at FHI and 3.8 billion yen at SIA. This includes an estimated gain of 14.5 billion yen (12.7 billion yen at FHI, 1.8 billion yen SIA) after recouping the losses from the previous year’s hike in material prices. The remaining gain of 7.3 billion yen (5.3 billion yen at FHI and 2.0 billion yen at SIA) will come from the reduction in cost of materials. Decrease of SG&A expenses and others will result in a gain of 17.4 billion yen. This amount can be broken down into four areas: (1) A decrease in fixed costs will result in a gain of 3.4 billion yen (0.7 billion yen at FHI, 2.7 billion yen at SIA). FHI will see an increase in expenses for suppliers’ dies (-3.3 billion yen) and a decrease in fixed processing costs (+4.0 billion yen). SIA ($26M) plans to reduce expenses for suppliers’ dies (+$38M) and other expenses (+$1M) but will see increases in depreciation (-$11M) and labor costs (-$2M). (2) A decrease in SG&A expenses will result in a gain of 7.1 billion yen. SG&A expenses will be cut at both FHI (+6.5 billion yen) and domestic dealers (+2.5 billion yen). SOA (-2.0 billion yen, -$20M) will see an increase in incentive costs (-$3M) although per-unit incentive is expected to remain at the previous calendar year’s level. SOA will also see increases in advertising costs (-$12M), market development costs (-$3M), and administrative costs (-$2M). SG&A expenses will be cut by 0.1 billion yen at our Canadian subsidiary and will increase by 0.2 billion yen at other subsidiaries. (3) Reduced costs associated with accrued warranty claims will result in a gain of 1.4 billion yen. (4) The remaining 5.5 billion yen increase in income will come as a result of other factors. Looking at the factors leading to reduced operating income, the deterioration of sales volume and mix will reduce operating income by 41.1 billion yen. This is broken down into three parts: (1) In Japan, operating income will rise by 5.1 billion yen thanks to the sales increase for passenger cars will improve sales mix. (2) Overseas, operating income will decline by 31.3 billion yen. The deterioration of the sales volume and mix during the first fiscal half will continue to have a negative impact throughout the year. (3) A drop of 14.9 billion is also projected in other business segments. Loss on currency exchange will total 27.1 billion yen. A seven-yen appreciation against the U.S. dollar will result in a loss of 16.2 billion yen. A twenty-two-yen appreciation against the euro will create a loss of 6.6 billion yen while a sixteen-yen appreciation against the Canadian dollar will result in a loss of 4.3 billion yen. Our plans for the coming fiscal year also include advanced R&D work. The increase in R&D expenses (from 42.8 billion yen to 43.0 billion yen) will reduce operating income by 0.2 billion yen. These factors combined will bring operating income down 29.2 billion yen. |