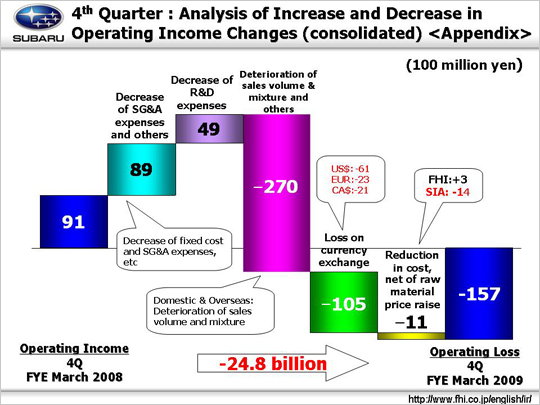

| Let’s look at why operating income slid from 9.1 billion yen to operating loss 15.7 billion yen. We gained 8.9 billion yen due to decrease of SG&A expenses and others. This amount can be broken down into four areas: (1) A decrease in fixed manufacturing costs resulted in a gain of 0.6 billion yen (-0.3 billion yen for FHI, +0.9 billion yen for SIA). (2) A decrease in SG&A expenses resulted in a gain of 10.0 billion yen. SG&A expenses were reduced both at FHI (+8.5 billion yen) and domestic dealers (+2.9 billion yen). SG&A expenses were also cut at SOA (+0.1 billion yen). SOA saw a year-on-year increase of $400 in per-unit incentive costs (-$8M, from $1,500 to $1,900) and a reduction in advertising expenses ($10M). Other factors for the decline include a loss of 0.7 billion yen incurred at our Canadian subsidiary, a loss of 1.3 billion yen at our newly consolidated subsidiaries, and a gain of 0.5 billion yen at other subsidiaries. (3) No costs associated with warranty claims were incurred due to inventory adjustments. (4) A loss of 1.7 billion yen was posted due to foreign exchange adjustments for procurements at subsidiaries. We gained 4.9 billion yen due to a reduction in R&D expenses (from 13.6 billion yen to 8.7 billion yen). R&D expenses were pared down as we completed the development of new models and streamlined advanced research to cut costs. At the same time a deterioration of sales volume and mix cut income by 2.7 billion yen. This can be broken down into three parts: (1) In Japan production and inventory adjustments resulted in a 9.8 billion yen drop. (2) Inventory adjustments for overseas operations also resulted in an operating income drop that totaled 24.2 billion yen. (3) We gained 7.0 billion yen due to inventory adjustments, etc. Loss on currency exchange created a 10.5 billion yen drop. The approximate 18 yen appreciation against the U.S. dollar resulted in a loss of 6.1 billion yen. The approximate 39 yen appreciation against the euro resulted in a loss of 2.3 billion yen. The approximate 34 yen appreciation against the Canadian dollar brought a loss of another 2.1 billion yen. Reduction in cost, net of raw material price raise resulted in a loss of 1.1 billion yen, a 0.3 billion yen gain for FHI and a 1.4 billion yen loss for SIA. Included in this loss was a 5.0 billion yen price hike for raw materials such as steel and resin and others (-3.4 billion yen for FHI, -1.6 billion yen for SIA). Cost of materials was reduced by 3.7 billion yen at FHI and 0.2 billion yen at SIA, for a total of 3.9 billion yen. The factors mentioned above led to a reduction in operating income that totaled 24.8 billion yen. |