|

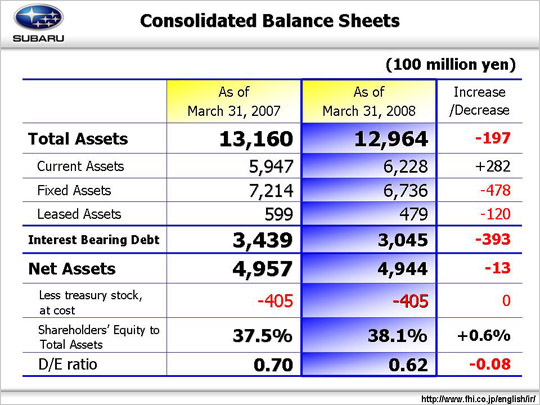

Next are the balance sheets. Total assets decreased by 19.7 billion yen year on year to 1,296.4 billion yen at the end of March, 2008.

Current assets increased by 28.2 billion yen due to an increase of 36.1 billion yen of inventory assets stemmed mainly from increased work-in-progress for Boeing 787s in the Aerospace Company and increased inventory of new model cars of SOA. Meanwhile, short-term loans decreased by 22.9 billion yen mainly due to the securitization of receivables by Subaru Finance, a financial subsidiary, for repayment of borrowings.

Fixed assets decreased by 47.8 billion yen mainly due to ongoing amortization of jig and die expense after SIA’s start-up manufacture of new models, impairment loss recognized at FHI’s main plant, SOA’s decreased leased assets, and decrease in unrealized holding gain on investment securities.

Total interest bearing debt decreased by 39.3 billion yen year on year to 304.5 billion yen at the end of March 2008 due to, firstly, 10 billion yen redemption of corporate bonds, and repayment of long-term and short-term borrowings and CP. The D/E ratio stood at 0.62.

Although we forecasted 329 billion yen of interest bearing debt for the end of the fiscal year ended March 31, 2008 (which was the deadline for a 20% reduction in interest bearing debt put forth in the revised FDR-1 business plan), we succeeded in further reducing interest bearing debt to 25 billion yen below the target.

Despite an increase in retained earnings, net assets amounted to 494.4 billion yen at period end due to a decrease in valuation, translation and other adjustments resulting from the stronger yen and lower stock prices.

Shareholders’ equity, which is the percentage of net assets (not including minority interests) to total assets, stood at 38.1%, for a 0.6% increase.

|