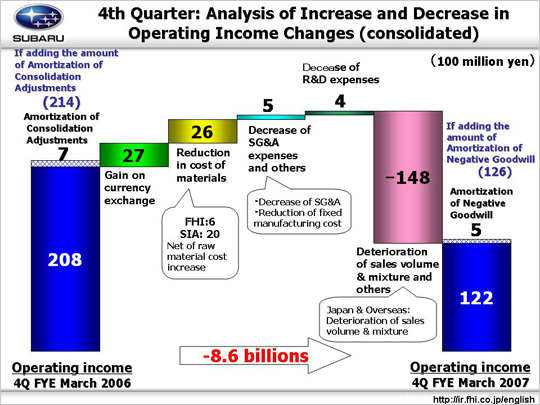

The causes for decreased operating income to 12.2 billion yen from 20.8 billion yen were:

Gain on currency exchange caused an increase of 2.7 billion yen. The depreciation of around 2 yen against the US dollar, resulted 1.4 billion yen gain. A depreciation of about 1 yen against the Canadian dollar added 0.2 billion yen gain due to the export from FHI to Canada. The strong CND$ versus US$ rate added 0.3 billion yen, due to the export from SIA to the Canadian subsidiary. These two totaled to 0.5 billion yen. The depreciation of around 16 yen against the Euro, added 0.8 billion yen gain.

Reduction in cost of materials added 2.6 billion yen, with 0.6 billion yen of this by FHI, and 2.0 billion yen by SIA. Included in these reductions were 4.0 billion yen of higher raw material prices, due to steel material shortages and other materials such as aluminum and precious metal worsened market conditions.

Decrease of SG&A expenses and others raised income by 0.5 billion yen. This is broken down into four parts. First, (1) Lower fixed manufacturing costs added 1.7 billion yen to the income (0.2 billion yen by FHI, 1.5 billion yen by SIA). (2) Lower SG&A expenses added 2.6 billion yen to the income. In Japan, lower SG&A expenses added 2.5 billion yen to the income, from both FHI (0.2 billion yen), and the dealerships and others (2.3 billion yen). In overseas, on the other hand, SOA also added to income by reducing SG&A expenses. SOA’s incentives were reduced about $100 below in the 4Q of the previous fiscal year, cutting 0.5 billion yen ($1,500 to $1,400), and advertising costs were cut by 0.1 billion yen. Other overseas subsidiaries increased SG&A expenses a little. (3) Costs increase of accrued warranty claims by 0.8 billion yen, associated with greater overseas sales. (4) The remaining 3.0 billion yen income reduction was due to other items.

0.4 billion yen was from lower R&D (13.7 billion yen to 13.3 billion yen). Efficient R&D is being promoted.

On the other hand, deterioration of sales volume and mixture reduced income by 14.8 billion yen. This is broken down into three parts. (1) In Japan, decreased passenger cars resulted in 4.6 billion yen lower income. (2) 7.8 billion yen drop in overseas. Both volume and mixture worsened. (3) Down 2.4 billion yen due to inventory adjustments, etc. {1.7 billion yen of unrealized inventory (0.8 billion yen in Japan, 0.9 billion yen overseas), 4.1 billion yen reduction due to the increased income at the 3 companies and other items}.

The above factors reduced the operating income by 8.6 billion yen.

|