|

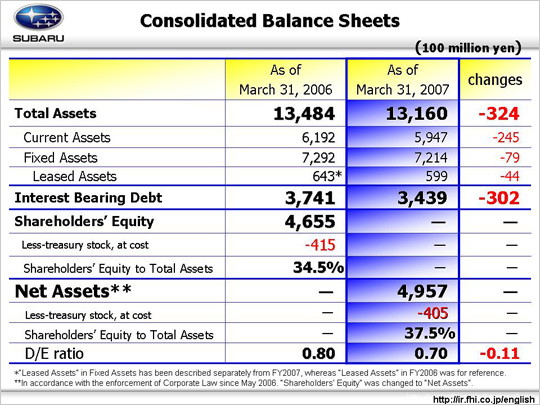

Next is the balance sheets. The total assets were 1 trillion 316 billion yen, 32.4 billion yen less from the end of the previous fiscal year.

The current assets fell by 24.5 billion yen, and the biggest cause of this was that FHI’s subsidiary, the Subaru Finance liquidated 25.0 billion yen of receivables to repay short-term borrowings. On the other hand, inventory increased due to the works in progress at the Aerospace Company for the Boeing 787 and the AH-64D for the Ministry of Defense, and also increased inventories of new vehicles at SOA.

The fixed assets decreased by 7.9 billion yen, but the primary cause was that after a new vehicle launching at SIA, depreciation for the tool & die costs is in progress.

Further, the leased assets are separately presented from this fiscal year, but these leased items were taken out of "machinery, equipment and vehicles", and from "other" in fixed assets, so the result for fiscal year ended as of March 31, 2006 is shown as a reference.

Regarding the interest bearing debt, 20 billion yen of straight bond was redeemed, but another 20.0 billion yen were issued anew, so the amount of straight bonds was unchanged. In addition, long-term and short-term borrowings were repaid, while commercial paper was issued by the subsidiary.

The total was 343.9 billion yen, 30.2 billion yen less than the previous fiscal year end, and that the debt/equity ratio was 0.70.

End of March, 2008 is the deadline for a 20% reduction in an interest bearing debt as noted in the revised FDR-1 plan, and the forecast for the interest bearing debt is 329.0 billion yen.

Also, regarding a negative goodwill (formerly "consolidated adjustments"), 2.2 billion yen was amortized related to fixed cost burden of SIA, which was the last of amortization related to Isuzu.

Associated with execution of the Corporate Law, "Shareholders’ equity" was changed to "Net assets", and minority interests in consolidated subsidiaries is included in the "Net assets", which totals to 495.7 billion yen. The shareholders' equity to total assets ratio, which shows a percentage of net assets excluding minority interest in consolidated subsidiaries, was 37.5%, up 3.0% from the end of the previous fiscal year.

|