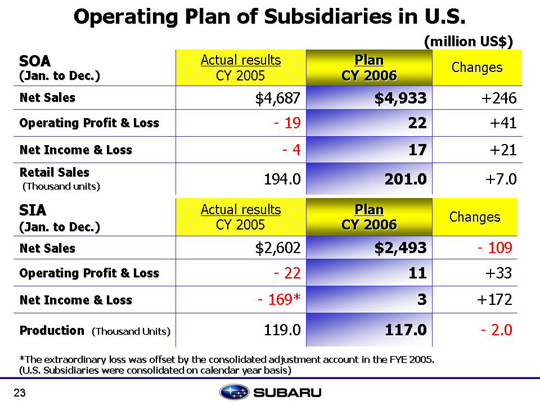

At SOA, the Impreza sales are expected to be favorable after the major facelift for a year-on-year increase of US$246 million. As for operating profit and loss, we are forecasting a US$14 million profit with an improved sales mix, but additional expenses are expected to be incurred for the leveraging of sales through increased incentives, more dealer development, etc. As we predict that the severe sales environment will continue, we will review our transfer price by taking foreign exchange trends and U.S. market competitiveness into consideration. In the first half, the B9 Tribeca will have a positive effect at SIA, but due to inventory adjustments during the year we expect production to decrease and for there to be a US$109 million fall in income. Thanks to cost reduction activities, we predict an improvement of US$51 million in the sales volume and mixture. However, rising raw material costs will have a negative effect. Additionally, depreciation expenses will rise, fixed and variable costs will rise due to higher costs for electricity and gas and increased medical insurance fees. These effects will be a US$ 33 million increase in income in total. Then we project a US$11 million of the operating profit at SIA. |