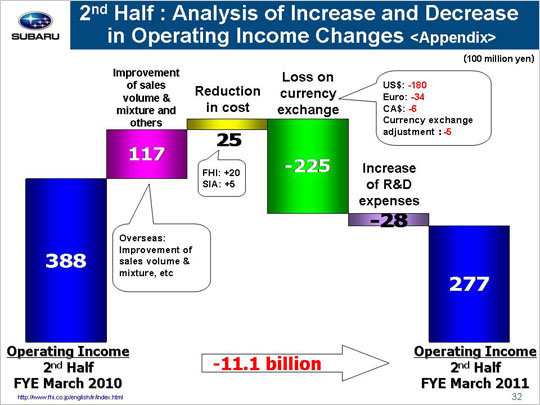

Now let’s look at the reasons for the projected year-on-year decrease in operating income that takes us from 38.8 billion yen to 27.7 billion yen.

There will be a gain of 11.7 billion yen due to an improvement in the sales volume & mixture and others. This gain can be broken down into three areas. The first is a projected loss of 12.6 billion yen in the domestic market due to a decrease in sales volumes as a result of the discontinuation of the eco-car tax subsidy programs. The second is a projected gain of 26.4 billion yen in overseas markets thanks to an increase in sales volumes in the U.S., Chinese and other markets. Finally, we expect to see a loss of 2.1 billion yen due to inventory adjustments and others.

We will gain 2.5 billion yen due to a reduction in materials costs, with a gain of 2.0 billion yen at FHI and a gain of 0.5 billion yen at SIA. FHI is expected to generate a gain of 9.6 billion yen through cost reductions with a loss of 7.6 billion yen due to increased materials costs and other adverse market factors. SIA is expected to generate a gain of 4.7 billion yen due to cost cuts and a loss of 4.2 billion yen related to rising material prices and other unfavorable market conditions.

Factors leading to a lower operating income will include a loss of 22.5 billion yen due to loss on foreign exchange. This includes a projected loss of 18.0 billion yen due to an approximate 7 yen appreciation against the U.S. dollar, a projected loss of 3.4 billion yen due to an approximate 20 yen appreciation against the euro, and a projected loss of 0.6 billion yen due to an approximate 4 yen appreciation against the Canadian dollar. This figure also includes an estimated loss of 0.5 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries.

Though we don't expect to see any gains or losses from changes in SG&A and other expenses, the factors for this can be broken down into the following three areas. First, we will see a gain of 3.5 billion yen in fixed manufacturing costs coming from a gain of 3.5 billion yen at FHI on top of zero gains and losses at SIA. FHI is expected to yield a gain of 2.2 billion yen due to decrease of the depreciation for suppliers’ dies and a gain of 1.3 billion yen due to lower fixed processing costs. SIA will gain 0.6 billion yen due to degrease of the depreciation for suppliers’ dies and lose 0.6 billion yen due to increased fixed processing costs. Next, we will suffer a loss of 4.3 billion yen due to an increase in SG&A expenses, with a loss of 1.9 billion yen at FHI and a gain of 2.5 billion yen at domestic dealers due to efforts to reduce SG&A expenses. SOA is expected to generate a loss of 4.7 billion yen. The loss will be due to the anticipated per unit incentive increase of approximately 200 dollars that will bring incentive figure from the 900 dollar of second half of last fiscal year to 1,100 dollars of this second half. This will come on top of a projected increase in sales volumes and virtually no changes in advertising costs and SG&A expenses. Our Canadian subsidiary will generate a loss of 0.1 billion yen while our other subsidiaries will yield combined losses of 0.1 billion yen. Finally, we will see a decrease in costs associated with warranty claims, which will lead to a projected gain of 0.8 billion yen.

We also expect to see a loss of 2.8 billion yen due to an increase in R&D expenses from 20.1 billion yen to 22.9 billion yen related to developing new models and more environmentally friendly features.

These factors combined are expected to bring operating income down 11.1 billion yen.

|