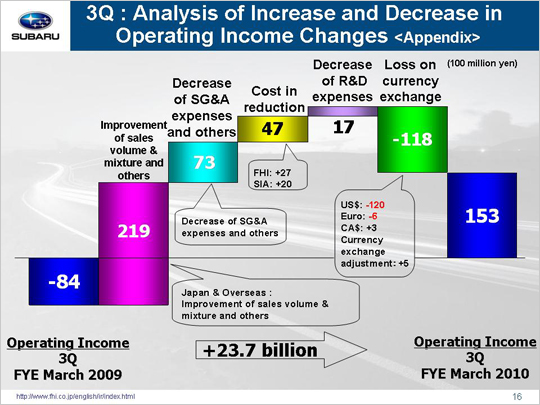

| Now let's look at the factors behind the year on year change in operating income for the third quarter period, in which we went from an operating loss of 8.4 billion yen to an operating income of 15.3 billion yen. The factors that led to the increase in operating income included a gain of 21.9 billion yen due to an improvement of sales volume and mix. This gain can be broken down into three areas: (1) The domestic market saw a gain of 5 billion yen thanks to increased sales of both passenger cars and minicars as well as an improved sales mix due to the effect of the new Legacy. (2) We saw a gain of 17 billion yen in overseas markets due to increased sales in North America, Australia and China as well as an improvement in the sales mix owing to the launch of the new Legacy. (3) We experienced a loss of 0.1 billion yen resulting from inventory adjustments and other factors. A gain of 7.3 billion yen was generated as a result of lower SG&A and other expenses. This gain can be broken down into two parts: (1) A loss of 0.9 billion yen in fixed costs came from a loss of 1.6 billion yen at FHI and a gain of 0.7 billion yen at SIA. FHI saw a loss of 0.7 billion yen due to increased fixed processing costs and another loss of 0.9 billion yen due to an increase in expenses for suppliers' dies. SIA saw a gain of $7M, which included a gain of $6M due to reduced expenses for suppliers' dies and a gain of $1M coming from reduced processing costs and other expenses. (2) A decrease in SG&A expenses resulted in a gain of 8.2 billion yen. FHI reduced advertising and SG&A expenses, leading to a gain of 2.1 billion yen. Domestic dealers generated a gain of 1.8 billion yen as our SG&A cost reduction efforts through consolidation of distributors. Despite a $4M advertising cost increase, SOA saw a gain of 3.7 billion yen ($36M) thanks to a reduction in SG&A expenses that saved $1M and a gain of $39M of incentive cost reduction as per-unit incentive dropped $750, down from $1,350 for June-September 2008 to $600 for October-December 2009,. While our Canadian subsidiary generated a loss of 0.7 billion yen, our other subsidiaries realized a gain of 1.3 billion yen due to ongoing cost reduction efforts. We gained 4.7 billion yen due to a reduction in materials costs, saving 2.7 billion yen at FHI and 2 billion yen at SIA. While FHI gained 4.6 billion yen as a result of cutting materials costs, it suffered a loss of 1.9 billion yen due to the spike in prices for precious metals and other materials. SIA gained 1.4 billion yen from a reduction in materials costs and another 0.6 billion yen after recouping its losses from the previous year's materials price hike. We gained 1.7 billion yen due to a reduction in R&D costs (down from 11.2 billion yen to 9.6 billion yen). This explains the temporary lull in new model development and our ongoing efforts toward increasing R&D efficiency. Operating income was diminished by a 11.8 billion yen due to foreign exchange loss as exchange rate fluctuations. This included a loss of 12 billion yen due to an approximate 11 yen appreciation against the U.S. dollar, a loss of 0.6 billion yen due to an approximate 5 yen appreciation against the euro, and a gain of 0.3 billion yen due to an approximate 1 yen appreciation against the Canadian dollar. These factors combined brought operating income up 23.7 billion yen for a total of 15.3 billion yen. |