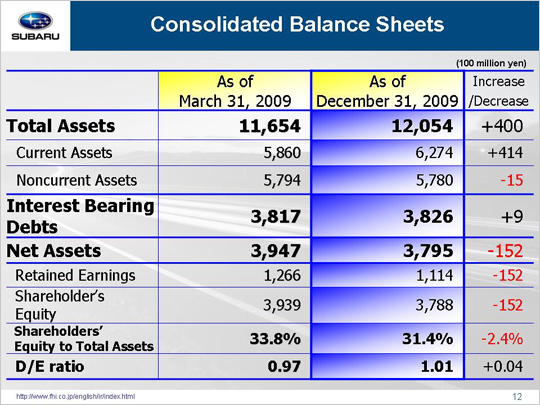

| The balance sheet shows total assets increasing by 40 billion yen over last fiscal year's end total to reach 1,205.4 billion yen. Current assets rose, with a 53.6 billion yen increase in cash and cash equivalents along with an improvement in working capital as a result of the completed inventory adjustment. On top of these results, inventory was reduced by 21.9 billion yen thanks to buoyant sales in North America. These factors were the primary engines driving total assets up. While our cash flow statements are disclosed in a quarterly report, you can see from the increases and decreases in current assets that operating cash flow has been improving while free cash flow has been in the black since the first quarter. Fixed assets remained the same level at the end of the previous fiscal year. While we have converted our short-term loans into long-term loans, interest-bearing debts increased by 0.9 billion yen from the end of the last fiscal year to total 382.6 billion. We plan to further reduce interest-bearing debts by 10 billion yen to bring the total down to 370 billion yen at the end of this fiscal year. Our debt-to-equity ratio was 1.01. Net assets totaled 379.5 billion yen, down 15.2 billion yen due to a decrease in retained earnings. The shareholders' equity to total assets ratio was 31.4%. Given these figures as well as the positive cash flow mentioned earlier, you can see that we have maintained a solid financial footing. |